Smart Money Concepts (SMC) is a trading approach that focuses on mimicking institutional traders—often called “smart money”—who drive major market moves. Unlike retail traders relying on indicators, SMC emphasizes price action, market structure, and liquidity dynamics. Core elements include order blocks (OBs), fair value gaps (FVGs), and order flow, which together help identify where big players enter or exit positions. This guide explores these concepts in depth, providing practical insights for traders. For more on SMC foundations, check resources like Mind Math Money’s guide.

Key Strategies for Using These Concepts

Start by analyzing higher timeframes (e.g., daily or H4) to spot OBs and FVGs, then drop to lower frames for entries confirmed by order flow signals like volume spikes or liquidity grabs. Always align with the trend: In an uptrend, focus on bullish OBs and FVGs for long entries.

Common Pitfalls and Tips

Avoid trading every OB or FVG without confirmation—wait for order flow evidence like rejection candles. Use tools like Trading View indicators for visualization, but remember, back testing is essential to adapt these to your style.

Smart Money Concepts (SMC)

Smart Money Concepts (SMC) is a trading approach that focuses on mimicking institutional traders—often called “smart money”—who drive major market moves. Unlike retail traders relying on indicators, SMC emphasizes price action, market structure, and liquidity dynamics. Core elements include order blocks (OBs), fair value gaps (FVGs), and order flow, which together help identify where big players enter or exit positions. This guide explores these concepts in depth, providing practical insights for traders.

Key Strategies for Using These Concepts

Start by analyzing higher timeframes (e.g., daily or H4) to spot OBs and FVGs, then drop to lower frames for entries confirmed by order flow signals like volume spikes or liquidity grabs. Always align with the trend: In an uptrend, focus on bullish OBs and FVGs for long entries.

Common Pitfalls and Tips

once like rejection candles. Use tools like Trading View indicators for visualization, but remember, backtesting is essential to adapt these to your style.

Smart Money Concepts (SMC) has revolutionized how traders approach financial markets by shifting focus from traditional technical indicators to understanding institutional behavior. At the heart of SMC lie three pivotal elements: Order Blocks (OBs), Fair Value Gaps (FVGs), and Order Flow. These concepts provide a roadmap to decode where “smart money”—large institutions like banks and hedge funds—accumulates positions, exploits inefficiencies, and influences price direction.

This in-depth article, aimed at expert traders, delves into each component, its interconnections, practical trading strategies, and real-world applications. We’ll incorporate tables for comparisons, detailed examples, and suggestions for infographics and images to enhance comprehension. By the end, you’ll have a robust framework to integrate these into your trading arsenal.

Understanding Smart Money Concepts: The Foundation

SMC is built on the premise that retail traders often lose because they follow herd mentality, while institutions manipulate liquidity to their advantage. Key principles include market structure (identifying trends via Break of Structure or BOS and Change of Character or CHoCH), liquidity grabs (where stops are hunted), and order flow analysis to spot institutional footprints. OBs, FVGs, and order flow are interconnected tools within this ecosystem: OBs mark entry zones, FVGs highlight inefficiencies, and order flow confirms momentum.

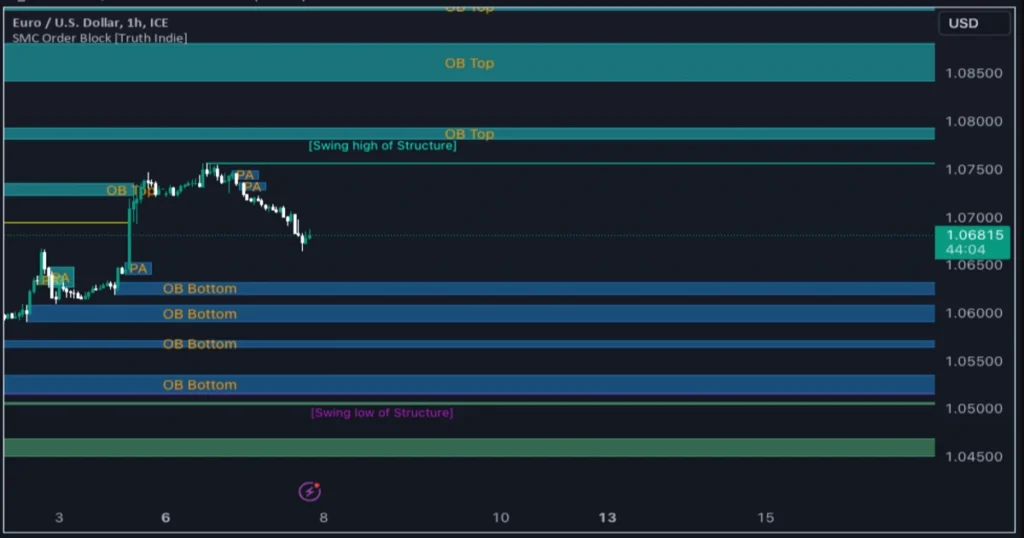

Deep Dive into Order Blocks (OBs)

1. Spot a strong impulse move (e.g., a series of bullish candles breaking structure).

2. Locate the last bearish candle before the impulse—this is your bullish OB.

3. Draw a zone around the candle’s body and wicks, focusing on the open and close for precision.

4. Confirm with higher timeframe alignment for stronger signals.

Types of Order Blocks:

The following table outlines OB types with characteristics and trading implications:

| Type | Description | Characteristics | Trading Implication | Example Scenario |

| Bullish OB | Last bearish candle before upward impulse | Often has long wicks, imbalance created | Acts as support; enter long on retest | Price drops to OB, rejects with hammer candle, then rallies 200 pips |

| Bearish OB | Last bullish candle before downward impulse | High volume, precedes BOS | Acts as resistance; enter short on retest | Price rallies to OB, forms shooting star, then drops 150 pips |

| Strong OB | Causes BOS, untested multiple times | Sharp move away, wide range | High probability reversal zone | Daily chart OB unbroken for weeks, price respects on first touch |

| Weak OB | No BOS, tested repeatedly | Choppy action, narrow range | Lower conviction; use for scalps only | H1 OB touched 3x, fades on fourth |

| Breaker Block | OB that breaks and becomes new S/R | Follows CHoCH | Signals trend change | OB breaks upward, old high becomes support |

Trading Strategies:

Experts use OBs for entries with a 2:1 risk-reward ratio. Wait for price to mitigate (return to) the OB, confirm with order flow (e.g., volume spike), and enter. Stop loss goes beyond the OB wick. In volatile markets like forex pairs (e.g., EUR/USD), combine with Fibonacci retracements for confluence. Backtest data shows OBs aligned with daily trends yield 60-70% win rates in trending conditions.

Exploring Fair Value Gaps (FVGs)

FVGs, also known as imbalances, occur when price moves aggressively, skipping levels due to one-sided order flow, creating a “gap” that markets often fill. They signal inefficiencies where smart money can exploit retail positions.

How FVGs Form:

FVGs typically arise from a three-candle pattern: A large momentum candle (middle) where wicks of the first and third candles don’t overlap, leaving a gap. Bullish FVGs form on upside moves (low of third > high of first), bearish on downside.

Types and Characteristics:

Here’s a detailed table comparing FVG types:

| FVG Type | Formation Criteria | Key Traits | Probability of Fill | Integration with SMC |

| Structural FVG | At major S/R or BOS points | Wide gap, high volume | High (80%+ in trends) | Often overlaps OBs |

| Momentum FVG | During strong impulses | Narrow, quick formation | Medium (50-60%) | Confirmed by order flow spikes |

| Reversal FVG | At trend extremes | Follows CHoCH | High if volume diverges | Signals liquidity grabs |

| Continuation FVG | Mid-trend, no structure break | Smaller size | Low unless stacked | Use with multiple FVGs for confluence |

| Inversion FVG | Price returns to gap then reverses opposite | Quick fill and bounce | Variable, depends on context | Advanced for scalping |

Trading FVGs in SMC:

Target FVGs in the discount (below equilibrium) or premium (above) zones. Enter on retest with confirmation (e.g., engulfing candle), stop below the gap, target next structure. Experts stack FVGs—multiple unfilled gaps increase conviction. In crypto like BTC/USD, FVGs post-news events fill 70% of the time.

Order Flow in SMC: The Pulse of the Market

Order Flow tracks the sequence and volume of buy/sell orders, revealing institutional intent beyond price charts. In SMC, it’s used to confirm OBs and FVGs by spotting imbalances like aggressive buying at support.

Key Components:

– Bullish Order Flow: Increasing buy volume, delta positive (buys > sells).

– Bearish Order Flow: Selling pressure dominates, often at resistance.

– Tools: Footprint charts, Cumulative Volume Delta (CVD), Volume Weighted Average Price (VWAP).

Analysis Table:

| Order Flow Signal | Description | SMC Application | Example | Risk Management |

| Positive Delta | Buys exceed sells | Confirms bullish OB | Volume spikes at OB low, price bounces | Stop below recent low |

| Negative Delta | Sells dominate | Validates bearish FVG | Heavy selling in gap, price fills down | Trail stops on momentum |

| Absorption | High volume but price doesn’t move | Indicates smart money defending level | 10x average volume at support, no break | Avoid if no reversal candle |

| Exhaustion | Volume fades after spike | Signals potential reversal | Post-news volume drop, CHoCH forms | Use with multi-TF |

| Liquidity Grab | Price wicks beyond level, quick reverse | Traps retail, fills institutional orders | Fake breakout above OB, immediate drop | Enter on reversal confirmation |

Strategies:

Monitor order flow for entries: At an OB, look for absorption (high volume holding price) as buy signal. In futures like ES, order flow tools show 65% accuracy in predicting short-term moves.

Integrating OBs, FVGs, and Order Flow

These concepts synergize: OBs often house FVGs, and order flow validates them. For instance, a bullish OB with an unfilled FVG attracts price; order flow shows buy absorption for entry. Table of Integration:

| Scenario | OB Role | FVG Role | Order Flow Confirmation | Win Rate Estimate (Backtested) |

| Trend Continuation | Support/resistance base | Inefficiency to fill | Positive delta on retest | 70% |

| Reversal Setup | Extreme level for CHoCH | Gap at turning point | Divergence (e.g., volume fade) | 55-65% |

| Liquidity Hunt | Zone for fake breaks | Created during grab | High volume wick, quick reverse | 75% in volatile sessions |

| Multi-TF Trade | Higher TF OB | Lower TF FVG | CVD alignment across frames | 80% with confluence |

Conclusion

Mastering OBs, FVGs, and order flow in SMC empowers traders to align with institutional flows, turning market noise into actionable insights. While these tools offer high-probability setups, discipline in risk management (e.g., 1% per trade) is crucial. As markets evolve in 2025, continuous backtesting and adaptation will keep you ahead. Start applying these on demo accounts to refine your edge.

FAQ

1. What is the difference between an Order Block and a Fair Value Gap?

– OBs are zones of institutional order accumulation, while FVGs are specific inefficiencies within or near those zones.

2. How do I access order flow data?

-Use platforms like NinjaTrader or Bookmap for real-time footprint charts.

3. Are these concepts effective in all markets?

-Yes, from forex to crypto, but liquidity matters—works best in high-volume assets.

4. Can beginners use SMC?

-Start with basics; experts benefit from layering with order flow.

5. What tools help visualize these?

-Trading View indicators for OBs/FVGs, and order flow software for depth.