A young retail dealer named Alex, a hump on your low-light screen in a small apartment, evaporating your hard-earned savings in a series of disappointing Forex trades. Night after night, he would pursue trends based on popular indicators, to see the market unnecessarily; he was shocked and destroyed. A scary evening, browsing the online forums, I stumbled upon Alex whispering of “smart money” – the invisible hand of institutional giants who drew the cord behind the price movements.

This revelation made him Michael J. Hodlston’s teachings, known as Inner Circle Trader (ICT). To start, as a doubt became a transformative journey, where Alex learned to decode the market’s hidden languages, which led to the loss continuously losses. This is the essence of the ICT trade strategy: a methodological approach that strengthens everyday traders to think as professionals, to guess tricks instead of responding to them. In this broad guide, we will elaborate on ICT, supported by statistics and expert insights, to help you navigate the financial markets with confidence, in depth.

ICT Trading Strategy: Origins and Fundamentals

Trade strategy, small for inner circuit dealer, an experienced forex trader, Michael J. It is a sophisticated feature developed by Hodlston, who has made thousands through its online programs. It focuses on traditional retail indicators as institutional actors – often called “smart money” – manipulate prices for profit. Unlike traditional strategies, which depend on units such as moving averages, ICT emphasises market structure, liquidity dynamics and value action to predict institutional behaviour.

In the core, ICT sees the market as a battlefield, where large institutions are hunting for the retailer’s stop-loss order and liquidity with positions. Hodlston, who began to share his insight through YouTube and private mentorships in the early 2010s, has created a consequence by demolishing these concepts. Statistics show that more than 90% of retailers have lost money in foreign currency, and often fail to match institutional currents, a difference that needs to be bridged by the ICT bridge. By studying ICT, traders can potentially improve winning awards; For example, a document of ICT concepts produced in futures and crypto markets 91–92% success rate in 100 trades.

To begin with, familiarise yourself with a high deadline as daily or 4-hour charts, as ICT emphasises multi-timeframe analysis as a reference. This basic understanding determines the phase to postpone the most important concepts.

Essential ICT Trading Concepts: From Liquidity to Balanced Price Ranges

Expert ICT needs greedy main elements, which create building blocks to analyse any market. These concepts help traders identify that smart money is likely to come in or leave the situation.

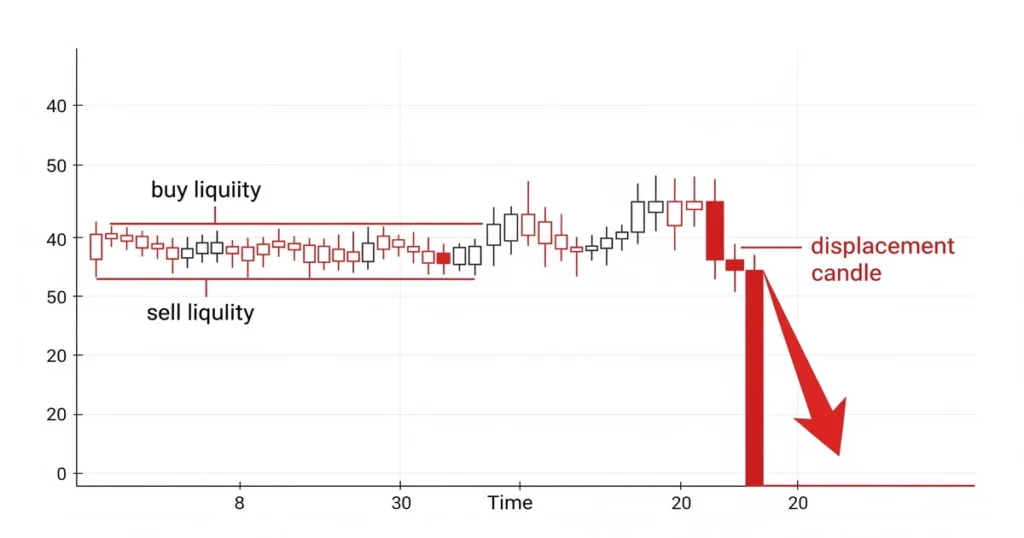

Liquidity: The basis of manipulation in the market

Quiddity refers to areas where large parts of the purchase or sale of order clusters, such as newer high or in climb, often where retail stop losses remain. Institutions “hunt” this liquidity, allowing prices to fill their mass orders without sliding too much.

In practice, you can detect the liquidity pool by noticing the same high/climb or turning points. In a fast trend, look, for example, for liquidity on the sales side below today’s price.

Step-by-step:

1) Identify the recent swing rise.

2) Draw horizontal lines at these levels;

3) See the price to sweep them before reversing. This concept alone can explain that the markets often imply unwanted traders before the market “fakes”.

Displacement: Spotting Aggressive Price Shifts

Display occurs when the value moves aggressively in one direction, which often indicates institutional accumulation or distribution, with large candles. This is the “impulse” phase after capturing liquidity.

To use it:

1) Monitor for a series of small candles (consolidation);

2) Wait for a Breakout Steering Light to shut off the border;

3) Confirm with volume when available. In Forex, where the volume data is limited, you can rely on the size of the candle-a-a-displacement light EUR/USD can have 50-100 pips. Statistics indicate that markets use 70% of the time, making displacement of larger breakout signals.

Market structure shift: Identification of trend reversal

A market structure change (MSS) occurs when the value breaks a previous high in a downturn or in a trend, indicating a possible trend change.

Step-by-step application:

1) high/high/high/high/high/climb for bumps;

2) Note when a new low/high structure switch occurs.

3) Look for confirmation through displacement. This change is often induced, helps with reversal with 60-70% accuracy in the tested model.

Motivated: Stop retailers

The motivated is a wrong step designed to maintain retailers in wrong positions, such as a short spike over resistance to buying triggers before a drop.

Use it:

1) Identify potential grid at main levels;

2) Avoid entries during these weeks;

3) To insert the counter in the induction after the sweeps. This prevents common damage, where 80% of the outbreaks basically fail.

Fair Value Gap: Opportunities in Price Imbalances

A reasonable price difference (FVG) is an imbalance with three wives where the first and low of low low not high overlap, with the “gap” institutions that are often filled.

Phase:

1) Scan after the impulsive movements, leaving intervals.

2) Mark the gap boundaries;

3) Shop the difference from order blocks. FVG-s are filled in accordance with ICT back tests in about 70% of cases.

Optimal Trade Entry: Time correct your steps

The optimal trade entry (OTE) uses Fibonacci retracement (usually 62–79%) from turn points to indicate entries after offset.

Treat:

1) Draw a fib to at least high in the trend;

2) Objective listings of 0.618–0,786 levels;

3) Combine with FVG -the assembly. This method increases the risk-reward ratio to 1:3 or more.

Balanced Price Range: Navigating Consolidation Zones

Balanced Price Range (BPR) forms when two opposing FVGs or displacements create a neutral zone, often leading to breakouts.

Steps:

1) Identify adjacent FVGs;

2) Trade the breakout direction;

3) Use for range-bound strategies. Markets consolidate 70% of the time, making BPR essential for patience.

Here’s a table summarizing these concepts:

| Concept | Definition | Key Indicator | Trading Application |

| Liquidity | Clusters of orders for institutions to tap | Swing highs/lows | Hunt sweeps for reversals |

| Displacement | Aggressive price impulse | Large candles | Signal trend continuation |

| Market Structure Shift | Break of prior structure indicating reversal | New highs/lows | Confirm trend changes |

| Motivated | False moves to trap retail | Fake breakouts | Avoid and counter-trade |

| Fair Value Gap | Price imbalance from impulsive moves | Three-candle gaps | Trade toward filling |

| Optimal Trade Entry | Fib-based retracement for entries | 62-79% levels | Precise timing |

| Balanced Price Range | Neutral zone from opposing imbalances | Adjacent FVGs | Breakout trades |

Using ICT trading strategy for accurate price movement Predictions

ICT Excel on forecast by matching institutional intentions. The goal is to estimate where the price will go to the manipulation structures.

Step-by-step guide:

1) Determine the bias of the total market when using a festive frame structure (eg high/high/climb); 2) Identify the liquidity pool on a short time frame.

3) Wait to motivate to sweep liquidity;

4) Look for displacement and confirmation of MSS;

5) FVG or order block space for entry;

6) Use OTE FIB levels for accurate time.

7) targets the next liquidity, handles the risk of stopping under the structure. In BPR scenarios, the edges of the outbreak fade. For example, in EUR/USD, if daily shows MSS, swipe 4H liquidity sweeps for long registrations. Backtests have predicted ICT with 60-80% accuracy when the collection matches. Practice demo accounts, as thousands of Profit companies use them to give an evaluation.

Professional and resistance to ICT trade strategy: a balanced view

ICT provides depth, but is not innocent. The benefits include better market understanding, leading to better risk management. Prop companies reported 90% of the errors by ignoring smart money. This promotes discipline, where users get an RR ratio of 1:3. Borders: Khadi Learning Status, Subjective Interpretations, and No Warranty. Frequency of Faults Varies. Some Studies have shown that only 10-20% traders have long had an advantage for a long time. It is time-intensive and can cause overanalysis. In short, ICT is powerful for dedicated students, but requires backtesting.

Conclusion

Evaluation of the gain capacity of the ICT trading strategy

In packaging stands the ICT trade strategy as a lighthouse for those who want to cross retail, and provide equipment to decode institutional exercises and promote permanent trading habits. With emphasis on structure and smart means, it has provided countless traders the opportunity to achieve stability, as explained by social reports on high victory rates in controlled tests. Still, remember that profitability rests on practice, discipline and adaptation – not every strategy fits every trader. As the markets move into 2025 and beyond, ICT remains a versatile structure. So, are you ready to use these concepts and change your trading journey?

FAQ

1. What does ICT stand for in trading?

-ICT stands for Inner Circle Trader, a methodology created by Michael J. Huddleston focusing on smart money concepts.

2. Is ICT trading suitable for beginners?

-Yes, but it requires dedication; start with basics like liquidity and structure before advanced setups.

3. Can ICT be used in all markets?

-Absolutely – it’s effective in forex, stocks, crypto, and futures due to universal price action principles.

4. What is the success rate of ICT trading?

-It varies; personal tests show 90%+ in some cases, but overall trader success depends on execution.

5. How long does it take to learn ICT?

-Typically, 3-6 months of consistent study and practice, including backtesting.