It is no secret that debt is an enduring phenomenon for everyday Americans, but if there is one thing that can be helpful, it’s knowing how to manage it. That can aid in enhancing your wealth. This particular guide has been written for learned investors in ages ranging from the 30s to the 50s with quite a bit of capital but are clueless about investments.

Defining debt involves including its expensive side instead of putting focus on the balance only that is to be left unpaid. It is preferable to keep low-interest loans until there is enough cash to pay off the highest interest rates to avoid stress in the future. Appropriate management can lead to great levels of credit scores and subsequently better financial conditions; poor management will do the opposite though. By the time you’ve finished reading this article, you will be in a position to take action where the debt is concerned to manage it better or, preferably, get it down.

What is a general understanding of Debt?

Managing debt should constitute sound considerations for making financial decisions. This also enables you to recognize when there is ‘good’ debt to be taken, for instance, investing in assets that will increase your overall position and taking ‘bad’ debt which will not enhance one’s input.

It is money, usually a sum of money which implies that you the borrower promise to pay this back with interest (according to Cambridge dictionary). It can be in many forms- credit cards, personal loans, mortgages or even student loans. Most of it , except negatively geared investment debts like a mortgage or a student loan, can be considered negative; however, excessive or unstructured debt may lead to a negative cash flow pattern and restrain one’s investment ability.

To begin exploring debt management tools, however, it is critical to point out that ‘knowledge is power.’ A lot of people seem to have a phobia in regard to investing or financial planning because they lack knowledge on the matters. Keep in mind, however, that you are educated and intelligent and understanding your finances is not beyond your comprehension. This is a message that this article intends to put across: you have the power to shape your own financial future.

Read More: https://trekandtrade.com/how-much-money-should-you-have-saved-by-age-30/

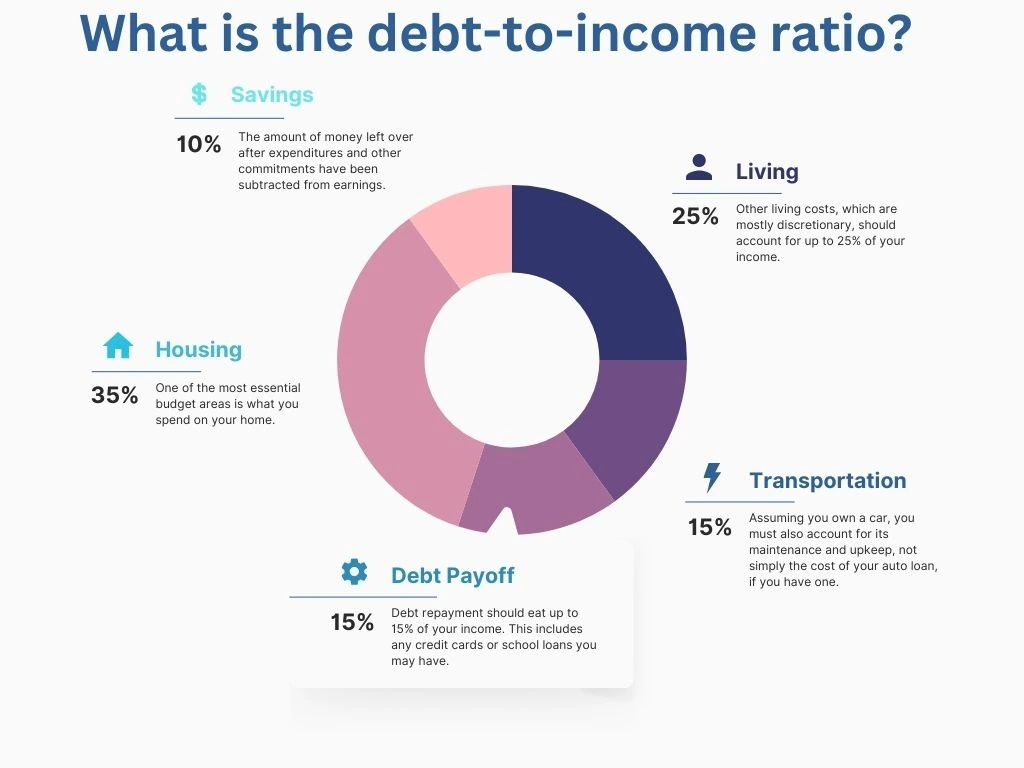

What is the debt-to-income ratio?

To calculate your DTI:

Tally up obligations for the month: List all recurring debts, e. g., mortgage payments, car loans and leases; student loan balances; credit card debt

In this budget calculator: enter all your monthly debt payments and the total amount of at the bottom with YOUR GROSS MONTHLY INCOME (BEFORE TAXES)Convert to a Percentage: Multiply by 100 to get a percentage.

For example:

- Total monthly payments: $2,000

- Gross monthly income: $6,00

DTI= (20006000) ×100=33%DTI=(60002000)×100=33%

A DTI ratio below 36% is generally considered manageable; above 43% may raise concerns for lenders.

How Do Interest Rates Affect Debt?

Absolutely! Interest rates have a direct influence on how much you end up paying for money that has been borrowed. Slightly higher interest rates make borrowing a bit more expensive and paying off loans somewhat harder.

Understanding Interest Rates

Fixed Rate: This does not change in the course of paying back.

Variable Rates: Ranging (and fluctuating) based on the market

With a lower interest rate, you can save money in two ways: total costs will be cheaper because of less paid in interest over time and your monthly payments would also decrease which might otherwise have eaten up some or all the amount saved.

Credit card debt: Generally, credit card has bank’s interest charges which are usually variable in nature and are linked to general market trends. When economic conditions worsen, the inflation rate rises, which increases the annual percentage rates (APRs) of credit cards and eventually results in the highest monthly repayment amounts and interest rates on leftover balances. That can also make it harder to pay off credit card advances.

Mortgages and Long-term loans: Practically, fixed rate loans can remain unaffected by high economic inflation or high-paid rates due to short-term interest rate changes. However, those who have variable or adjustable-rate mortgages (ARMs) are directly influenced. When high-interest inflation strikes, such loans have increased monetary repayments and may create long term debt management issues.

| Interest Rate | Monthly Payment | Total Interest Paid | Total Payment |

|---|---|---|---|

| 5% | $188.71 | $1,622.36 | $11,622.36 |

| 10% | $165.53 | $3,963.44 | $13,963.44 |

Debt management Techniques?

There are many ways to deal with debt effectively and here are some of the common strategies you can adopt.

Work out a plan: Monitor your income and expenses by then categorize where you can save and spend.

Pay High-Interest Debt First: Target the highest-interest borrowings (usually credit cards) while making minimum payments on others

Debt Consolidation: Combine several debts in one loan with lower interest rates.

Use Automatic Payments: Automatically pay your bills in order to avoid late fees as well as build up credit. You can discuss the rates and payment plans with creditors, so don’t shy away from doing that.

What are the 5 C’s of debt?

Lenders typically check the 5 C’s of Credit, Character, Capacity, Capital, Collateral and Conditions during debt evaluation or loan application. All these factors support the underwriting of a borrower.

- Character: This is your credit history and how good you are at repaying borrowed money. This is because lenders look at your credit score and how you have managed borrowing in the past.

- Capacity: It is a judgement of your ability to repay a loan in proportion with the income and obligations you will carry over into this new level of debt. This is usually accomplished with the debt-to-income (DTI) ratio.

- Capital: This includes your personal assets that could be leveraged in as collateral for a loan

- Collateral: Loans can be collateralized, secured by the value of assets pledged against a loan amount, which helps lower risk to lenders.

- Conditions: This includes the specifics of the loan as well as outside economic factors that may affect your ability to repay.

Read More: https://trekandtrade.com/why-do-u-s-markets-control-the-world/

Frequently Asked Questions (FAQs)

Why is it important to understand debt?

Understanding debt is critical to financial well-being. The decisions you make about when and how to borrow money can impact your finances for a long time.

How do you explain debt?

Something owed. Anyone having borrowed money or goods from another owes a debt and is under obligation to return the goods or repay the money, usually with interest. For governments, the need to borrow in order to finance a deficit budget has led to the development of various forms of national debt.

How to repay debt?

1. Figure out how much you owe. Write down how much you owe to each creditor.

2. Focus on one loan at a time. Start with the credit cards or loans with the highest interest rate and make the minimum payments on your other cards.

3. Put any extra money toward your loan clearance.

4. Embrace small savings.

Is debt good or bad?

Key Takeaways. Debt can be considered “good” if it has the potential to increase your net worth or significantly enhance your life. A student loan may be considered good debt if it helps you on your career track. Bad debt is money borrowed to purchase rapidly depreciating assets or assets for consumption.

Conclusion

Debt is never viewed as punishment and if done right, it can be managed with the help of clarity and all relevant tools. Always bear in mind that investing doesn’t mean spending a lot of money at the beginning; even starting small is okay at the beginning, since over time, such small figures can grow remarkably.

Having learned the strategies for managing debt and investing, you have put yourself in a position to make choices that ultimately make you more financially free. Begin with taking charge of your finances and using some of these strategies, so that your older self is really proud of you. Time and time again, this blog in question makes it a point to sensitize the readers to not just know what it is, but also act on it when necessary. All this is to say that each person should take their financial future into their hands.