A small business owner stands on a fork in the road. On the one hand, it is the famous hometown-friendly Taylor and a strong building with decades of history. On the other hand, there is an even smartphone that offers instant account setup and condition-art features. Which way is he going to go?

This modern bank dilemma reflects an alternative to many Americans: reliable, full-service traditional banks or new neo banks. Both promise safe places to park money and pay bills, but they work very differently. In this article, we will find out their most significant differences – from services and fees to customer experience – to help readers. Consumers, fintech subjects, and owners of small businesses decide who is right for them.

Traditional banks offer a broad menu of financial products, accounts, loans, credit, investments, etc., while Neobank focuses on core-friendly services with some Xtras.

Traditional banks are a one-stop shop for innovative ES:

They also provide check and savings accounts, mortgages, cars and personal loans, credit cards, investment accounts, and often small business banking. In other words, you need something from a bank – safely from depositing cash to getting commercial loans – usually available under a roof. For example, most banks handle both individual and commercial accounts, so owners of small businesses can manage their financing in the same institute.

Significant differences in services:

In short,

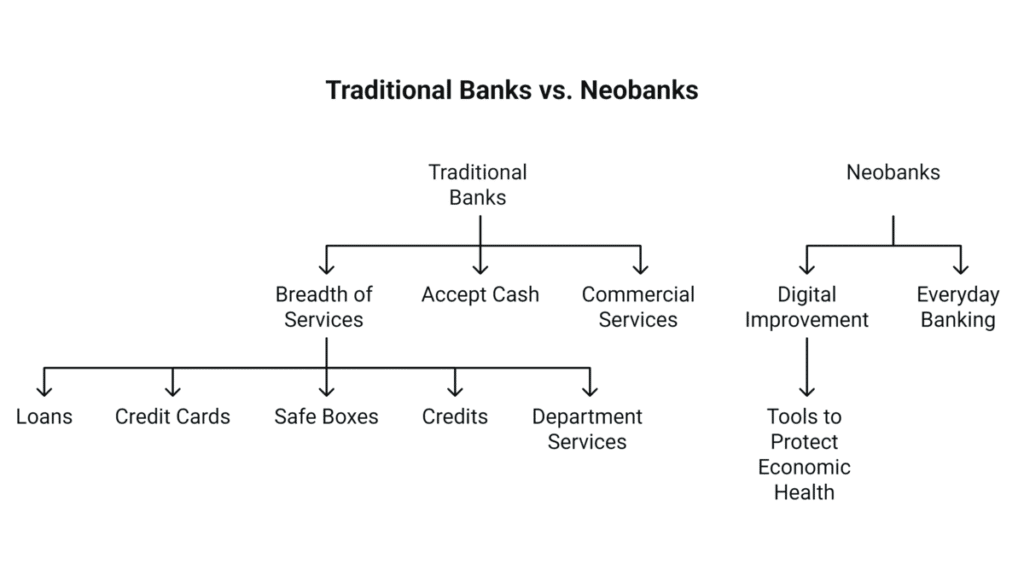

- Traditional banks have a breadth of services (loans, credit cards, safe boxes, credits, department services)

- while Neobanks emphasizes digital improvement and everyday banking.

- Traditional banks often accept cash and offer commercial services;

- Neobanks almost never do. The product menu is expressed and analyzed in the opposite industry infographic (see figure above) and analyzes:

- Traditional banks cover “all banking mandatory,” while neobank prioritizes “tools to protect economic health.”

| Services Offered | Traditional Bank | Neobank |

| Account types | Wide range: personal and business checking & savings, investment accounts, loans, mortgages, credit cards | Primarily personal (and some business) checking & savings; often have debit cards, high-yield savings, and finance tools |

| Loans & credit | Full suite: mortgages, auto loans, personal & business loans, credit lines, and credit cards | Limited or no mortgages/loans; some credit-builder cards or small personal/business loans via partners |

| Cash handling | Cash and check deposits at branches or ATMs; in-person services | Generally, no cash deposits (bankers rely on fee networks like Green Dot); digital payments only |

| Other features | Broad services: notary, safe-deposit boxes, wealth mgmt, treasury mgmt | Focused features: real-time notifications, budgeting apps, automated savings, crypto access |

Fees and costs

Neobanks usually do not require too low fees, while traditional banks still have many maintenance and transaction fees. One of the most significant sales points with Neobanks is their cost structure. Because neobanks operate online and leave the expenses for branches, they can often eliminate or reduce fees for everyday services.

Many popular neobank accounts have no monthly maintenance fee, no minimum balance, and no box creditors or ATM tax. For example, chimes and other people regularly waive $ 30+ cover taxes that will be charged to traditional banks. Experience notes that neobank accounts often have “low or no fee” and even have more interest in deposits.

Traditional banks are still a lot on fee revenue. Monthly account fees, ATM recreation fees, checkout fees, and minimum equipment are standard in brick-and-mortar banks. “Neobanks usually do not require fees for the necessary bank products … Traditional banks … fees”. Banking surveys suggest that many consumers collide with different fees in large banks. A specific American check account can actually carry a $ 10- $ 15 monthly maintenance fee if you do not meet balance requirements. In short, neobank accounts usually save customers money by trimming hidden costs.

Customer experience and access

Neobanks offer 24/7 digital convenience and intuitive apps, while traditional banks offer personal branches and human service trade with each other.

A significant difference is how customers interact. Neobanks is designed for mobile/web use. You can open an account over your phone in minutes, then check the balance, transfer money, or deposit a check at any time, often through the mobile app. There are no branch hours to worry about – your bank is always open online.

The modern FinTech app has smooth user interfaces, real-time transaction alerts, budgeting insight, and often chat or chatbot helpdesk. In fact, some surveys suggest that most Americans, about 77%, now prefer to manage accounts through mobile apps or computers instead of going to a branch. FDIC reports that about half, 48.3% of American families already use mobile banking as their primary channel. Young customers especially gravity for these digital first services.

Traditional banks, reverse, mix digital channels and brick-and-mortar. You can still go to a branch to talk to a banker, insert cash, or use an ATM. For many customers, especially old or rural people, access is valuable. Traditional banks usually have extensive branch networks, often nationwide, and physical appearance, which means that cash deposits, notaries, and personal advice are easy to obtain. However, branches have limited hours, and new accounts often require paperwork from the individual. Support at the conversation level and lobbying times can also decrease compared to a fast app pressure.

Studies reflect this trade band. Those who do not use online banking cite a priority for branches that are 45% of the causes. On the other hand, 96% of digital bank users consider their mobile experience as “good” or better. In summary, Neobanks stand out about the convenience and accessibility of banking in the pocket 24/7-Mens traditional banks stand out in support of tangible services and face-to-face.

• Access: Neobank: 100% online (app/site). Traditional: Branch + online.

• Support: Neobank: Chatbot or 24/7 digital support. Traditional: Bankers, telephone support (limited hours).

• Digital Tools: Neobank: State -of -The -Art app UX, Instant Alert, Easy Money Management. Traditional: Often more basic online portals (many improvements are made, but they can feel inherited).

• Branch Services: Neobank: None (no cash deposits, no physical advice). Traditional: Cash and coin handling, notary, secure reports, etc.

Technology and innovation

New features, while traditional banks are heavy investments in AI, Sky, etc., but are interrupted by cultural monuments.

Neobank was born of technology. They use cloud-based platforms and application programming interface APIs to connect services, which allow them to quickly update features and integrate them with apps such as pay or accounting. Many Neobanks can connect to the business accounting software or automate the tracking of expenses with some cranes.

They also use algorithms to reduce credit, sometimes including non-traditional data, and provide real-time financial insight. Because they leave the old software “Core Banking,” they can roll out innovations such as shopping to buy or instant crypto trade compared to traditional institutions.

Traditional banks catch. In recent years, large banks have spent billions on digital changes. An industry survey from 2024 found that about a third of the bank’s customer experience budget now goes to AI and machine learning. Around 61% of banks reported using AI for tasks such as credit analysis, risk assessment and fraud detection, and used AI about half a use in customer marketing or service. In practice, this means that traditional banks are quickly using chatbots, future analysis for borrowed decisions, and even robot recommendations for investments.

Regulation and security

Traditional banks are strongly regulated and standard FDIC-BIMIT. Neobanks are also under bank claws but are often insured with banks. Both must meet strict safety standards.

Both types of institutions are subject to bank claws eg the bank secret law, anti-mani-white washing rules, electronic fund transfer laws, etc. It is important that in traditional banks, customers are inserted FDIC-BIMIT, which is insured up to $ 250,000 per account and guarantees security. Most consumers rely on their money in a large bank, as the US government legally supports them.

Neobanks must navigate carefully. Technically, many neobanks are not knocking themselves – they are fintech companies. So, they generally cooperate with an FDIC-limit bank to carry out customers’ deposits. Plade explains: “Most Neobank is a partner with a traditional bank with a bank charter … and FDIC is insured”. For the customer, this means that you are usually FDIC-covered money put into a neobank, but it is intelligent to confirm which bank is on the back. Some neobanks have gone the extra mile: For example, the National Bank became the first fintech to receive the charter in 2020, so it can secure deposits directly and even issue a loan.

Main point of regulation:

Traditional banks: Chartered state or national, heavily monitored and standard of FDIC-Bimit. Neobanks: Usually unchanged fintech “rely on the Banks Charter of your fellow bank”. In any case, the consumer is used in safety transactions. Clean effects: Either deposited on the type is safe (if properly insured), but only chartered institutions can lend or retain credit risk. Always make sure your neobank funds are covered by FDIC through an insured partner.

Suitability for small businesses

Neobanks, with their adaptability and technology-centred approach, are ideal for small businesses with low centres. They offer features like loans, cash management, and personal services that can be tailored to the needs of a traditional bank.

For owners of small businesses, the convenience of neobanks can be a game-changer. They offer features like immediate expense classification, easy integration with accounting equipment, and simple online invoices. Digital banks also allow for speedy account setups and low fees, making them a perfect fit for lean start-ups.

As an analyst says: “Small Business Neobanks has become a difficult threat to community banks”, “distribute functions that are more advanced and wider”, and are fast innovation. If your business is primarily online, runs on a mobile device, or accepts automation and cost defence, a business-focused neobank such as Novo, brakes, mercury or others can be very attractive. These neobanks usually offer facilities such as the issuance of instant cards, bookkeeping dashboards and seamless Pewall tools, a term used to describe financial management tools for gaming jobs or freelancers.

On the other hand, if your business is heavily treated in cash, physical deposits are required, or require credit lines or commercial loans, traditional banks have clear benefits. Almost all traditional banks offer business control with ATM access, cash offices and support in commercial accounts. They also provide SBA loans, credits and commercial mortgage loans – products do not provide most neobanks. Traditional banks also give you a dedicated business banker who can advise on debt or complex transactions and appreciate many small owners. In short, a brick-and-mortar bank is often better for companies that want a reliable local partner, require customized services or handle money.

For a Better Understand key Points and table:

- If you mainly do digital business, prize modern technology and automation, you can confidently turn to Neobank, at least cash requirements, and want to reduce banking costs. Many online businesses, freelancers and technological startups fit this profile.

- Traditional banks are a reassuring choice if you handle significant cash or check deposits, a variety of credit products loans, lines, mortgage loans or face-to-face relationships and extensive services are required.

- Many companies find a sense of empowerment in using both: For example, keeping part of a digital account with no fee while maintaining a traditional bank for salary or lending needs.

| Feature | Traditional Bank | Neobank |

| Branches & Access | Extensive branch and ATM network. In-person service available. | No physical branches; app/web only. Digital tools replace in-branch functions. |

| Account Types | Full suite: personal & business checking/savings, loans, credit, mortgages, investments. | Core accounts: personal (and some business) checking/savings, debit cards. Limited lending (mostly via partners). |

| Monthly Fees | Often charges maintenance fees, ATM fees, overdraft fees. Rates may apply on checking. | Rare or no monthly fees on basic accounts; minimal ATM and overdraft fees. Higher yields on savings. |

| Technology | Older core systems; improving mobile apps but slower releases. | Modern cloud-based systems; mobile-first apps, APIs, real-time features. |

| Customer Service | In-person bankers, phone support during business hours. | Online chat/support 24/7. Primarily self-service via app and website. |

| Cash Handling | Accepts cash/coin deposits at branches or partner ATMs. | Generally does NOT accept cash directly; often uses partners for ATM deposits or cash reload cards. |

| Loans & Credit | Full loan products (mortgages, auto, SBA, business lines). Credit cards, etc. | Limited: some credit cards or small loans via partner banks. No mortgages or major commercial loans. |

| FDIC Insurance | Deposits insured by FDIC up to $250K. | Deposits typically insured through partner bank agreements. (Some neobanks, like Varo, now hold charters and insure directly.) |

| Ideal for | Customers needing broad services, credit, or handling cash; those who value face-to-face advice. | Tech-savvy users seeking convenience, lower costs and modern apps; small startups/freelancers with minimal cash needs. |

Conclusion

Finally, each of the traditional banks and neobanks has strengths and weaknesses. Traditional banks excel in offering a personalized approach, safety, and a wide range of services, making them ideal for those with complex financial needs. Neobanks, on the other hand, stand out with their innovative features, low fees, and modern services, catering to the needs of a digitized lifestyle and entrepreneurs. Both are now vying to cater to your unique needs.

The right choice is entirely up to you and your preferences. Do you value high-tech facilities and low fees, or do you prefer the comprehensive services of a full-service branch? A hybrid approach, maintaining accounts in both types, is the best fit for you. The power to choose is in your hands.

As you weigh your options, it’s important to remember Jane’s journey at the beginning: Banking is not just about money; it’s about trust and experience. Which model, the established bank or the app-based challenger, do you trust with your financial future? What does your banking experience mean to you, and who can deliver it best? Trust and experience are the cornerstones of your banking decisions.