Imagine waking up one morning to see a well-known start-up – for many years on the front of economic news. Once, there was a private dream in a garage that now becomes “public” in the stock market. This milestone phenomenon is called an Initial Public Offering (IPO), and it can change overnight: founders and early investors become rich, and everyday investors suddenly have a new stock to buy.

As an expert in finance with more than 10 years of experience, I have seen companies such as Amazon, Google, and Airbnb in the New Stratosphere. I have also seen the advertisement and the risks that come with it. In this guide, we aim to understand what an IPO really is, how the process works, and what investors should know before they participate.

What is an IPO?

An initial public offering (IPO) is the first time a private company sells its stock to the public on a stock exchange. In other words, the company is “going public” and a handful of private owners (as founders and corporate capitalists). By issuing shares in a stock exchange listing, the company raises significantly new capital – it can spend the money, which it can use for development, pay off loans, or invest in new projects. For example, the famous 2004 Impairment listing is included, as well as Facebook’s list of 2012, which includes events that have immediately created billionaires and public companies that conduct a significant amount of trade.

Tech IPO in America (1980-2023). The Dot-Com Boom (late 1990s) saw around 370 US technological stock exchange listings in a single year. An IPO often follows the trends of large industries.

The technical sector has operated a listing specially. During the 1999 Dot-Com bubble, around 370 technological start-ups were public in a year. Recently, COVID-19 led to a surge in technology and biotechnology as investors shifted to e-commerce and digital services. In short, a stock exchange listing occurs when companies and investors agree that the time has come for the company to enter the public markets. Initial investors can then sell some of their shares on the stock exchange and realize their investment.

IPO and first day come back.

The blue sector reflects the excerpt from the listing companies’ negative income on the listing, which increased from ~ 20% (1980s) to about 80% by 2020. Unprofitable is an average first-day stock return for a profitable stock exchange listing. Especially a lot of money is liked by construction companies, which still “pops” on the first day.

It is also noteworthy that most listing companies are not profitable when they go public. In 2020, around 80% of the IPO had negative income. Investors often pay for development capacity. Historically, many IPOs experience a strong first-day value, although the company does not yet generate profits.

IPOs are how companies first sell shares to the public. They publicly convert private companies into businesses, provide capital, and enable early owners to cash out. This process can create a huge winner (and losers) between both companies and investors.

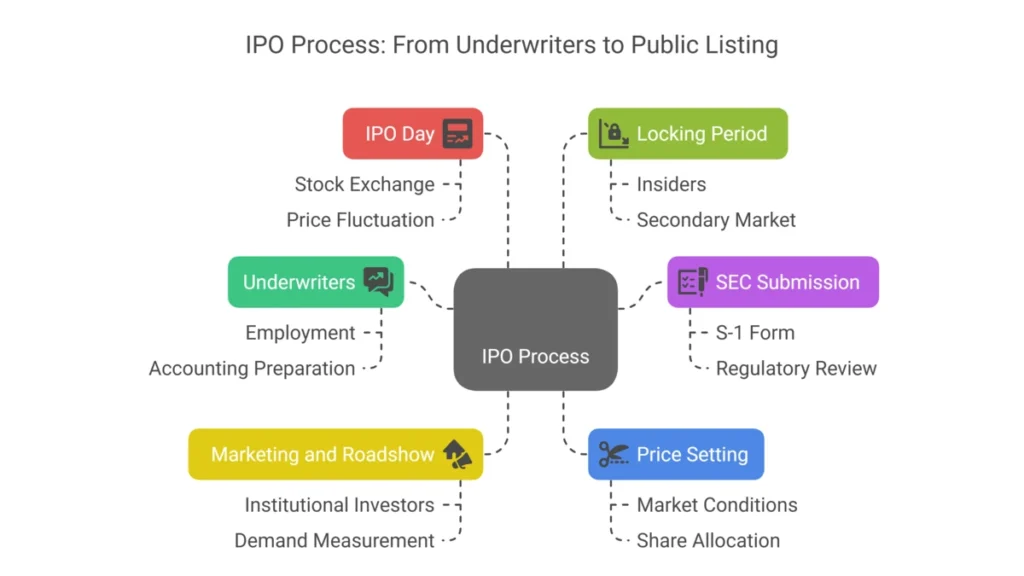

IPO process

Publishing a company is a long, multi-step process. Here is a simplified observation of specific listing stages:

1. Employment of Underwriters (Investment Bank): The company hits one or more investment banks to manage stock exchange listings. These banks (called underwriters) work closely with the company, help prepare accounting, and structure the offer.

2. Prepare SEC submission: U.S. In, the company submits registration details (usually an S -1 form) with the Securities and Exchange Commission (SEC). The document reveals the company’s business model and financial and risk factors and outlines plans for utilizing ITO funds. Regulators undergo and ask for clarification.

3. Marketing and Roadshow: Business Services and Underwriters run a “roadshow,” which offers business to institutional investors (mutual funds, hedge funds, etc.). They use this marketing to measure demand and interest. Investors react to potential stock exchange listing.

4. Price settings and sharing of sharing: Depending on demand from the roadshow and market conditions, the insurance companies determine the final stock exchange price. It often receives a discount to ensure that investors are willing to buy. Banks then assign shares to their customers (large institutional buyers and some retail customers).

5. IPO Day (Listing): On the first trading day, the company’s stock begins trading on a public exchange (e.g., Nasdaq or NYSE). If demand were strong, the price of the stock would “pop” over the offer price; If demand was weak, it could fall. Historically, insurance companies often provide the price of a stock exchange listing to facilitate moderate first-day growth.

6. Locking period: After a stock exchange listing, the insiders (founders, employees, and early investors) are usually subject to a lock-up agreement—a legal restriction that prevents them from selling additional shares during a fixed period (often 90-180 days). It protects against floods by selling to new investors. When lock-up finally ends, they can enter the secondary stock market, which sometimes causes fluctuations in stock prices.

Each step takes time – often from 6-12 months from the beginning to public listing. The key is that underwriters and SECs ensure the company provides complete information to public investors before they buy.

Advantages and Disadvantages of IPO Investing

Investing in a stock exchange listing provides unique benefits—and unique risks. In the table below, we summarize the main advantages and disadvantages of the company being public:

| Advantage | Explanation | Disadvantage | Explanation |

| Access to capital | Raises significant funds for growth, R&D or debt paydown | High costs | Underwriting, legal and compliance costs (upfront and ongoing) can be very large |

| Liquidity for insiders | Founders, employees, and early investors can sell shares and realize gains | Ownership dilution | Issuing new shares reduces the percentage ownership of existing shareholders |

| Increased visibility | Public listing boosts brand awareness, credibility and can attract customers or top talent | Market volatility | Stock price may swing wildly; market pressures and quarterly reporting can distract management |

| Better borrowing terms | Transparency and listed stock often lead to lower interest rates when raising debt | Increased scrutiny | Must disclose business details publicly, reducing privacy and potentially helping competitors |

As the table suggests, a stock exchange listing provides the company with large new financing and credibility and offers a market for selling shares to internal sources. On the other hand, IPOs are expensive and complex, and the ongoing regulatory requirements present a burden. Public shareholders also mean that management should file

ill the market’s expectations, which gives pressure. In short, the public can provide fuel for the next growth phase of a company, but investors must remember these trade-offs: Significant capital and liquidity often fall with high fees, loss of control, and the cost of the stock market.

Tips for IPO Investors

If you are considering investing in an IPO, there are some practical suggestions and best practices:

• Do your homework: Read the IPO prospect (e.g., SEC Form S-1 filing) carefully. Review the company’s financial development plans and competitive landscape. Remember that many listing companies lack profits from listing, so focus on factors such as sales growth, market share, and management quality instead of relying on them alone.

• Consider time: You don’t have to buy the first day. Often, it pays to wait. While many listings initially “pop” above the offer price, the data reveals that the majority in the market tend to reduce over time. If you remember the overload of the first day, you can avoid sales in a short time or get a more stable price.

• Diversity, do not focus: Treat an IPO as any high-risk investment. About two-thirds of the IPO was limped behind the market three years after the construction. Do not assign a large part of your portfolio to an IPO. Diversification helps to reduce the risk of falling into a single stock. In fact, research suggests that taking advantage of extensive risk is beneficial. Consider an IPO-centric ETF to spread the risk.

• Use a qualified broker: To apply for an IPO, you usually require an account with a broker participating in the offering. Many online brokers offer stock exchange forms, where you log in and indicate the number of shares you want to purchase at a specified offer price. Note: Popular IPOs are often oversubscribed, so you can receive smaller allocations by requesting them.

• Long -term focus: Think about the years to come. A short-term flip (selling immediately) can be attractive, but many investors aim to hold the IPO for a long time. Historically, IPOs from companies with strong sales have performed better in the long term than those from companies with small incomes. Look for companies with solid development opportunities, not just publicity.

• Consider the option: If choosing an individual stock exchange listing seems very risky, an IPO-centric ETF is a viable alternative. For example, the Renaissance IPO ETF has a basket of recent US stock exchange listings and has almost no overlap with the S&P 500. This allows you to widely diversify your risk in new public companies without holding the same stock multiple times.

conclusion

Initial public offerings (IPOs) are an attractive intersection between a company’s development and investor opportunity. The public can go public by raising funds for a company and expanding its range, but it also incurs huge costs and new pressures. For investors, the IPO presents an opportunity to buy in early on a story, but the road ahead is uncertain. IPOs often appear in a day, but over time, they tend to have many matches. The key is to balance enthusiasm with caution: do your research, understand the risk, and invest only what you can afford to wait.

Now that you have learned ins and boycott of stock exchange notes – from definitions and steps to professionals, resistance, and tips – consider how (or if) a stock exchange listing fits your strategy. Want to be one of the investors ready to buy in the next large public offer?