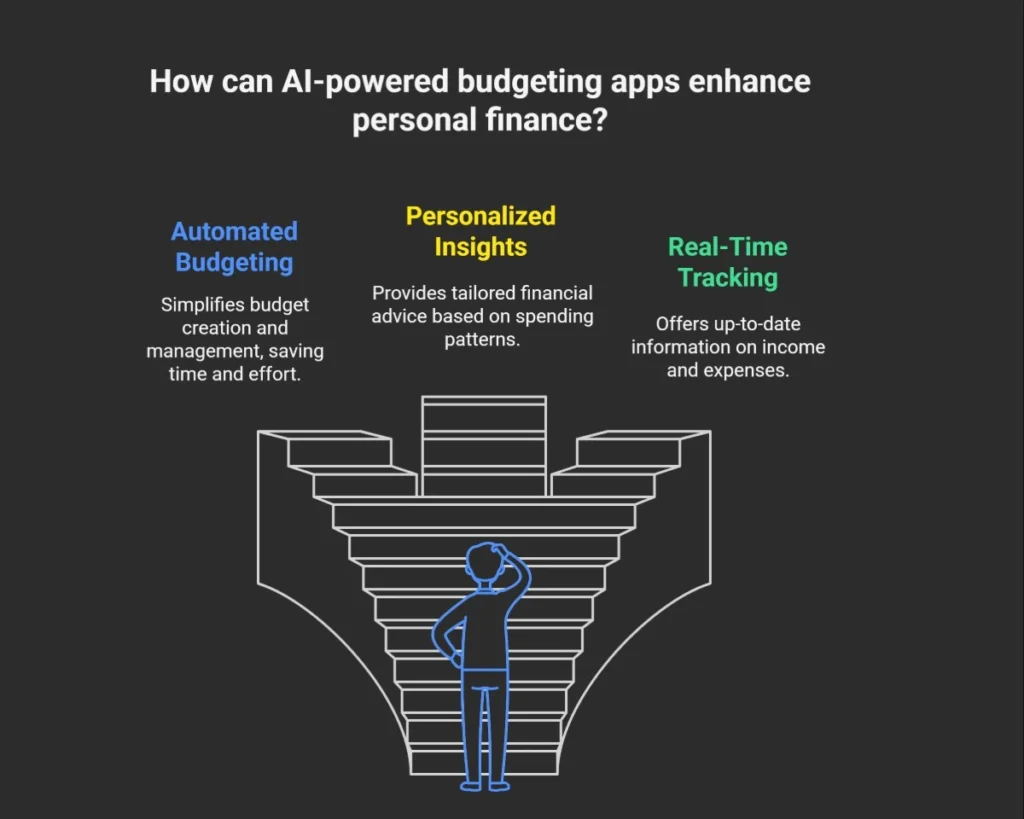

Managing personal finance no longer insists on the spreadsheet or receipts. Thanks to AI-operated budget and financial apps, everyday users can now automate savings and track consumer habits. Even an app can interact with a low bill on their behalf. These smart tools bring revolution in the way they interact with their money – making economic health more accessible, automated and intelligent than ever.

This smart money move explains how AI-powered budgeting Apps Are Transforming Personal Finance runs. This change provides step-by-step instructions to effectively use these devices and helps you choose the right app based on your financial goals. If you’ve ever wondered how to make your budget easy and smarter, this post is for you.

AI What is the budget app run?

AI-driven budget tags are financial equipment that uses machine learning as well as data analysis to know your expenses, predict future expenses and provide personal financial advice. These devices gain popularity due to increasing demand for consumers for smart financial management and increasing comfort with digital financial platforms.

How AI traditionally improves budget

Unlike traditional budget units, which require manual input and fixed categories, AI budgeting apps for your behavior teacher. They automatically classify expenses, detect nonconformities and propose an analog budget based on real-time data.

In today’s market, apps such as Cleo and Copilot have gained traction because of their intelligent classification, connivance interface and future analysis. When Fintech investment increases globally – by 2026, expected to become a hit of more than $ 500 billion – more sophisticated AI properties will be ideal.

How does the AI budgeting apps work

AI budget equipment usually follows these steps to manage your money:

Connect your accounts: Link your Bank Account, Credit Card, Loan and Investment. The app certainly provides transactions and balances.

Analyze your data: Read your machine learning model transactions and find the pattern. They classify expenses, groceries, bills, etc. and spot trends in repetitive membership.

Determine the goal and budget: You set a budget or goal (such as a saving of $ 200/month or reducing food). AI uses former habits to suggest realistic goals.

Automatic and Wake: The app automatically assigns the income in budget categories and sends notifications if you are overshadowed. Some apps save or also automatically invest in small amounts when cash is available.

Individual advice: Through notifications or chatbots, AI provides personal suggestions such as “You can save $ 15 by switching phone plans” and gently naked to stay on the field.

Important features of AI budgeting apps:

Automatic tracking: Any more manual entry – transaction washer and categories are updated on their own.

Predictive Alert: The app can warn you of the upcoming box credit or unusually high bill.

Smart Insights: Get analog recommendations, such as “Your dining budget was 15% last month. Consider setting a low limit.”

AI -Chat or Coaching: Someone who contains an AI -Chatbot can ask questions “Can I endure this purchase?” Or fun challenges that save savings.

Top AI Budgeting Apps of 2025

| App | AI Features | Best For |

| Cleo | Conversational AI chatbot, spending analysis, savings rules | Fun, chat-based budgeting |

| Digit (Oportun) | Smart savings (round-ups, automatic transfers), investing | Automated saving, small investments |

| Albert | Budget planning, expense categorization, human “Genius” support | Hands-off budgets + expert help |

| Qapital | Goal-based saving rules (round-up spending, spend-limits) | Gamified savings, custom triggers |

| Charlie | AI assistant that reads transactions and chats savings tips | Personalized advice via text chat |

| Monarch Money | AI “financial assistant” for budgets, goals, net worth | All-in-one budget/goal tracker |

Each of these apps has a unique approach, but they share a goal: to make the budget easier. Something below is highlighted:

Cleo: “The world’s first AI Financial Assistant” is marketed; CLEO offers a chat interface where you can ask about your accounts. It tracks the expenses, sets the budget, and even humorous “roasting” overshadowing, making finance more attractive.

Millions of people use Cleo to save their real-time insight and challenges.

Digit (Oportun): The number saves quite a lot of money. It is AI that “analyzes your expenses and automatically transforms small amounts of money into a savings account.” When you find out that you have extra cash, you can also invest these savings. Think of it as an automated savings choreographer that works in the background.

Albert: This app automatically makes you a budget from the revenue and bills. It classifies revenue/expenses and sends a notice to prevent supervision

, Albert Albert also provides Genius, a paid feature where human advisers offer personal coaching. This app automatically makes you a budget from the revenue and bills. It classifies revenue/expenses and sends a notice to prevent supervision

, Albert Albert also provides Genius, a paid feature where human advisers offer personal coaching.

Qapital: A target-driven savings app where you make rules

, These creative triggers feel saved like a game. Finance buzz notes that “automatic savings apps like Capital make it easy to save money by helping you do it with more regularity and low effort.”

Charlie: An AI that links to your bank and then provides advice on personal finance. It flags the bill, suggests coupons and sends a favorable reminder through text or chat. Charlie made the financial insight into fast, action-rich tips.

Monarch Money: Not a chat-based app, Monarch is a comprehensive Money Manager marked as an “AI Financial Assistant.” You set and track unlimited savings goals, budget and net value in one place. Users admire the emperor for their pure interface and target tracking, although it requires a payment subscription. Each app offers its prices many free basic schemes. Most AI budgeting apps cost a few dollars a month for premium features. In general, they are cheaper than hiring a financial advisor, given how much manual effort they save you.

AI VS Traditional Apps: Compared to Old School apps such as Mint or spreadsheet, AI tools work a lot. Instead of manually assigning each expenditure into a category, AI automatically classifies 90-95% of your transaction. This then uses machine learning to notice if you are out of your budget and can return you. As a medium writer said: “Agentic Ai is here to change the [bad budget] to handle the dull parts of money management.

Automatic savings and expenses notice

Monitor savings apps. They save quiet money or cut costs for you:

Round-up savings: apps like Qapital or Acorns (also popular outside our list) purchased in the next dollar and stopped the change. It uses “passive” changes for the construction of savings.

Rules for income trigger: You can tell some apps, “When I get payment, take $ 100 to save.” AI does this automatically.

Bill Talks: Services that rocked Money (formerly Troubleil) use AI algorithms to scan your bills. They interact on your behalf and share savings with you. (For example, a rocket money check can be paid too much on the internet or cable bill and can save you by getting better offers.)

Member Tracking: AI flag repeating membership you must have forgotten. One click can cancel them and save money for you.

Cashback and Deal: Some AI will score the network coupon code or cashback deals when you shop online and market your budget effectively.

These automated savings features mean that your budget has “assistants” that work in cost cuts. In fact, “General Zars, Millennials and General Exercise more than $ 100,000, one of the four using one of the four” one of the automated savings apps “(according to industry analysis) – a trend that only grows as consumers, shows how easily savings can be. To work these functions, you can build an emergency fund or reach the goals quickly.

| Feature / App | Cleo | Digit (Oportun) | Albert | Qapital | Monarch Money |

| AI Assistant / Chat | Yes (conversational bot) | No (focus on saving) | No (focus on budgeting) | No (focus on rules) | No (insights only) |

| Auto-Savings | Round-ups, challenges | Round-ups, auto-transfers | No (manual rules) | Custom rules (round-up, spends) | No |

| Budget Analysis | Yes (alerts) | No | Yes | Limited (mainly rules) | Yes |

| Personalized Tips | Yes (witty tips) | No | Yes | No | Some (insights) |

| Platform | iOS, Android | iOS, Android | iOS, Android | iOS, Android | iOS, Android, Web |

| Cost (Premium) | $0–$$ per month | $5 per month† | $4–$16+ per month | $3–$12 per month | $9.99 per month |

FAQs

1. Can AI really save me money?

Yes, by analyzing expense patterns, automating savings and reducing unnecessary expenses, many users report significant financial reforms.

2. What is the difference between a robot recommendation and a budget app?

Robo comments manage your investment using algorithms. Budgeting apps help use and save.

3. Do I have to connect all my accounts to use these apps?

Although it is not mandatory, adding many accounts provides a complete financial image and improves the app recommendations.

4. Will the use of these apps affect my credit points?

No, budget tags don’t check hard credit. However, they may suggest devices affecting credit if used such as debt or credit products..

conclusion

The AI-operated budget apps are no longer futuristic-they are here, more smart than ever, and are ready to become important financial equipment. In today’s economic environment, where inflation, debt and financial uncertainty are top concerns, these apps provide clarity, automation and security.

Whether you aim to save more, use less or gain a deep understanding of your financial behavior, an AI device is ready to help. As technology develops, we expect even more innovation to manage money.

Have you tried the AI budgeting app so far? Share your experience in the comments below, and don’t forget to give this guide to someone ready to take smart control over finance!