A man, at the age of 25, decided to control his financial future. He began making $ 200 monthly investments in the S&P 500 index funds. He did not chase tips on hot stock or try to spend time in the market. Instead, he trusted the power of continuous, long-term investment. Fast forward. For today, at the age of 35, his portfolio has increased significantly, making him a millionaire in the field within his 50s. The production of money through the stock market is worthy of getting everyone with the right strategies.

This article highlights the secretary of the secret millionaire to produce funds in the stock market. Supported by research and expert insights, we will discover proven strategies, current market trends, and practical proposals to start or increase the investment trip. Whether you are an early or experienced investor, these principles can lead you towards financial freedom.

The Path to Millionaire Secrets

Becoming a millionaire through investment in the stock market is not about luck or internal knowledge – it’s about discipline and time. A study of the Ramsey solutions of more than 10,000 millionaires found that 8 out of 10 invested in the company’s 401 (K) plan, and utilized tax-advantaged accounts to increase their money. In addition, 75% of millionaires invested continuously outside the company’s plans, emphasizing the importance of diversification.

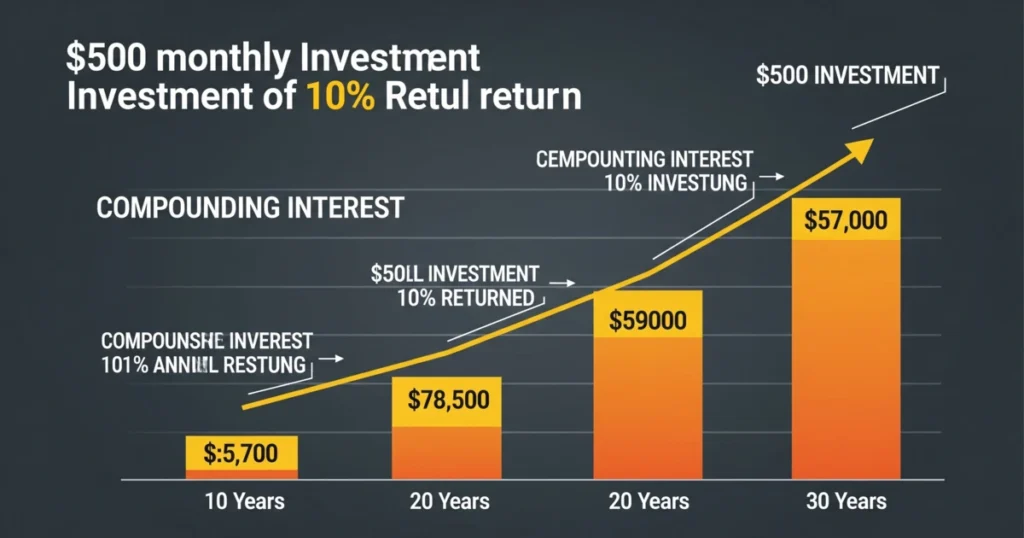

The key to success? Regular, long-term investment. This study showed that 75% of millionaires attributed their wealth to continuously investing over time by using the power of compound interest. For example, an investment of $ 500 monthly in the S&P 500 index fund with an average annual return of 10% can be more than $ 1 million in about 30 years. The first start increases this effect, as even small contributions can snowball over decades. Start investing as soon as possible and maintain continuity to earn composite interest.

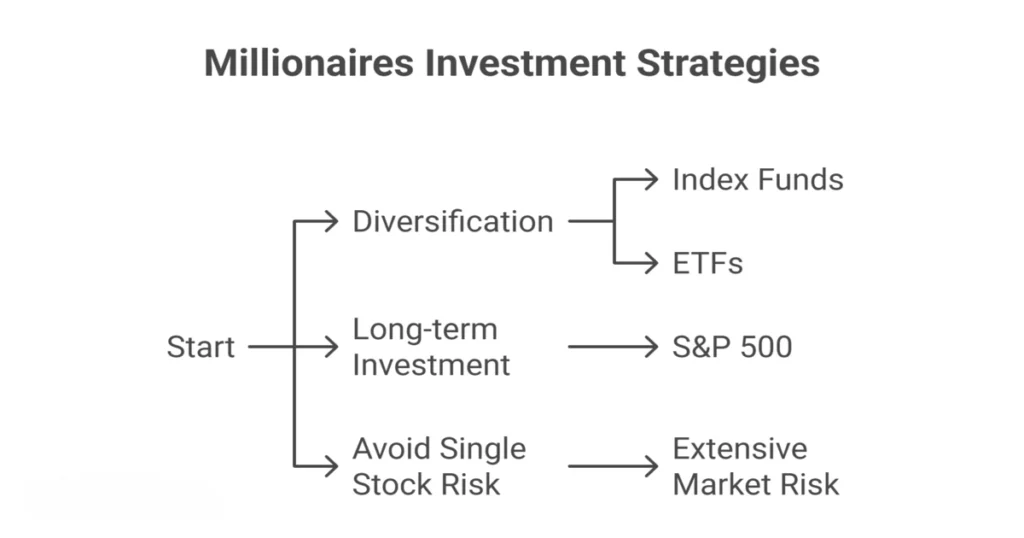

Millionaires Investment Strategies

Millionaire uses strategic approaches to maximize returns, which reduces the risk. Here are three main strategies that they use:

Diversity: Instead of investing in the same stock, millionaires spread their investments across different assets. Index funds and stock market-traded funds (ETFs) are popular alternatives, as they are at risk for hundreds of companies, reducing the risk. For example, an S&P 500 index fund includes the 500 largest US companies and offers immediate diversification.

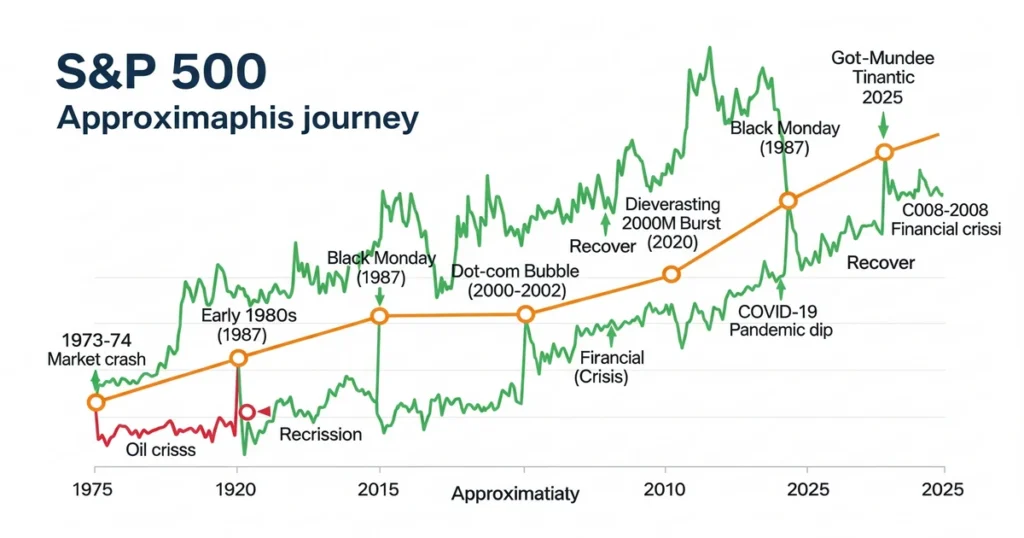

Long-term investment: Millionaires short-term trade and markets avoid time, which is risky and often unprofitable. Instead, they are invested through market fluctuations, knowing that the S&P 500 historically yielded an average annual return of about 10% before inflation since 1957. This long-term perspective allows the investment to increase continuously.

Avoid the risk of a single stock. The RAMSE study found that no millionaire referred to single stock investments as a primary factor for his success. Personal shares take high risk, as a single company’s failure can cause significant damage. Millionaires prefer extensive market risk through different means to reduce this risk. Include variants in your portfolio, focus on long-term development, and avoid high-risk single stock investments.

Current Market Landscape

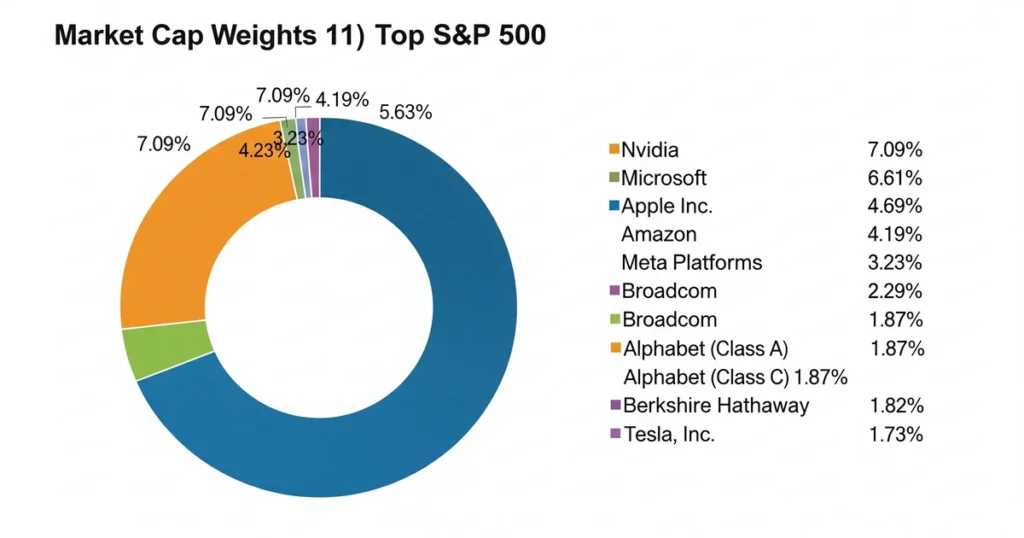

In July 2025, the S&P is trading around 6,225.51, reflecting a strong market environment. In the last century, the index has yielded an average annual return of about 10%, although inflation has averaged close to 6-7%. Strong growth has been observed in recent years, climbing on the S&P 500 to 23% in 2024 alone.

The 10 best companies dominate the index of market for the market, where Tech giants have led the package. Below is a table of the top 10 S&P 500 companies after market share by July 2025:

| Rank | Company | Symbol | Weight |

| 1 | Nvidia | NVDA | 7.09% |

| 2 | Microsoft | MSFT | 6.61% |

| 3 | Apple Inc. | AAPL | 5.63% |

| 4 | Amazon | AMZN | 4.19% |

| 5 | Meta Platforms | META | 3.23% |

| 6 | Broadcom | AVGO | 2.29% |

| 7 | Alphabet (Class A) | GOOGL | 1.97% |

| 8 | Alphabet (Class C) | GOOG | 1.87% |

| 9 | Berkshire Hathaway | BRK.B | 1.82% |

| 10 | Tesla, Inc. | TSLA | 1.73% |

While these companies are market leaders, their dominance does not guarantee future performance. Investors should focus on a diverse portfolio instead of chasing individual shares. The S&P 500 provides strong development capacity over a long time, but diversification is important.

Tips for interested millionaires

Ready to start the journey with money? Here are practical steps to follow:

1. Start quickly: The more you start, the more the investment must increase. Even $ 100 monthly can have a significant effect in decades.

2. Invest: Set an automated contribution to investment accounts to ensure regular investment regardless of market conditions.

3. Diversity in your portfolio: Use index funds or ETFs to spread risk in many companies and regions.

4. Automatize Investment: Automatize the transfer to mediation or pension accounts to make the investments comfortable.

5. Learn yourself: Read books, follow recognized financial blogs, and consider consulting a financial advisor to refine your strategy.

6. Rebalance regularly: review your portfolio annually to ensure it this with your goals and risk tolerance.

Small, continuous action and ongoing education can make enough money over time.

Common mistakes to avoid

Avoid this damage to keep you on track:

1. Market in time: The attempt to predict the market’s height and climb is risky and often leads to a lack of opportunities. Stick to a long-term plan.

2. Hunting warm tips: Social media and friends can avoid stocks, but they often bet. To rely on research and different investments.

3. Neglect diversification: Over-investment in a stock or sector increases the risk. Spread your investments to protect against losses.

4. Emotional decisions: Fear or greed can lead to high purchases and low sales. Be disciplined and follow your investment plan.

Discipline and diversification are important to avoid expensive errors.

conclusion

The creation of funds through investment in the stock market is a proven way of financial freedom, as shown by countless millionaires. You can follow their footsteps by starting early, investing in your portfolio, and avoiding general losses. The stock market rewards patience and discipline, not quick improvement or risky games. To start the journey today, take inspiration from the story and strategies mentioned here.