Investors increasingly want to put their cash to work for each profit and reason. Environmental, Social, and Governance (ESG) investing, also called sustainable or socially responsible investing, lets you try this via screening businesses for green practices, social responsibility, and sound company governance. In ESG, environmental elements may consist of a business enterprise’s carbon footprint and resource use; social factors, cowl labor practices and diversity; and governance elements include board ethics and accounting transparency.

The intention is to help organizations align with values like easy energy and equality without sacrificing returns. In 2025, the trend maintains: over $6 trillion in U.S. Properties is actually tied to sustainable strategies, and high-profile budgets and ETFs provide lower-priced ESG options. This guide will break down ESG making an investment, spotlight 2025 trends, and show you how to invest in ESG finances grade by grade.

Why Sustainable Investing Matters in 2025

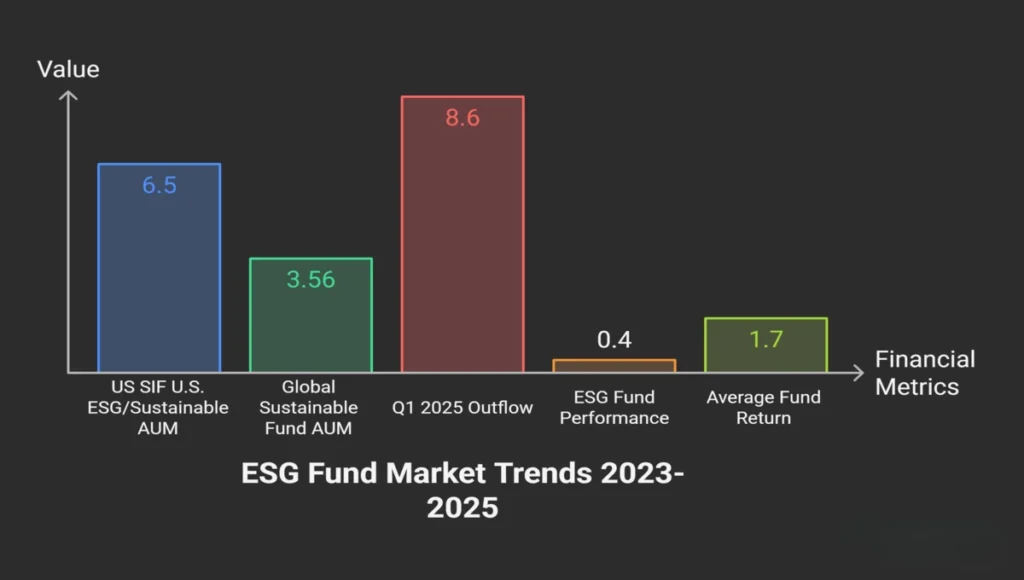

Why Sustainable Investing Matters in 2025- Sustainable investments quickly form finance. Studies show that most investors (about 7 out of 10) believe that companies should include ESG goals, and the industry’s report confirms mass growth. For example, the U.S. Sustainable Investment Forum (US SIF) found that of $ 52.5 cars in U.S. assets, $ 6.5 disorder is clearly in ESG or permanent means. Globally, Sustainable funds hit a record of $ 3.56 trillion in property by the end of 20124. This growth is inspired by factors such as concerns about climate change, consumer demand and policy change. An American SIF survey recently reported that 73% of investment personnel are expected to significantly increase the fixed market over the next 1-2 years.

However, market data shows unstable short-term trends. Sustainable Reality Report February 2025 noted that although permanent fund AUM reached a new level, its average return in H2 2024 was only 0.4%, which hangs after a 1.7% return to traditional funds. Similarly, Morningstar found that Q1 2025 saw a pure outflow of $ 8.6 billion from global permanent funds – a powerful reversal at the end of 2024. In ordinary terms, ESG funds saw strong flow in 2023 but recently met a setback due to a change in market conditions. This suggests that when ESG’s properties have increased, the results and investor interests may be upset.

Looking ahead, most analysts remain optimistic. Many permanent funds still win stocks such as Microsoft or Nvidia (ESG 20 pics) and can strengthen the new rules (e.g., SECS proposed climate information) ESG data quality. Big trends: ESG investment is no longer a niche but mainstream. ESG 20 report says, “ESG Theory is just as relevant today as he was 40 years ago”.

ESG Fund Market Trends and Data

To keep ESG development in perspective, consider these data points from 2023-2025:

• AUM growth: Sustainable and ESG-labelled funds now have a total of Billion dollars. US SIF U.S. ESG/Sustainable Aum reports $ 6.5 T. Globally, the sustainable fund AUM to $ 3.56T by the end of 2024.

• Flow and performance: At the end of 2024, lasting means of fresh flow (H2 2024). But Q1 2025 marked a reversal: a record of $ 8.6B in the outflow quarter. In fact, the United States tolerated ten straight quarters of net withdrawal until the beginning of 2025. This shows that investors are increasingly more selective. In terms of results, the report ESG fund hangs after peers at the end of 2024, 0.4% compared to 1.7% average return. Still, some ESG funds saw a big gain. So, when many ESG funds have been recently reduced, top permanent investments can still provide prominent benefits.

• Investor inspiration: Demand is inspired by personal values. IN a PWC survey, 70% of investors want ESG to be produced in a corporate strategy. After all, many people ask, “If the government does not prioritize climate change, how can I support it?” An answer is through the ESG portfolio.

Together, these trends are, on average, 2025, a decisive year: Permanent investment is large and impressive, but investors have to evaluate the money carefully (especially the recent headwinds given). Good news: Regulatory standards and ESG ratings improve, and computer equipment is widely available, making it easier to finance more than ever.

Top Performing ESG Funds

| Fund Name | 1-Year Return | Expense Ratio | Category |

|---|---|---|---|

| iShares MSCI USA ESG Select ETF | 13.8% | 0.15% | ESG Equity |

| Vanguard FTSE Social Index Fund | 12.5% | 0.14% | Large-Cap Blend |

| Nuveen ESG Large-Cap Growth ETF | 14.2% | 0.20% | ESG Growth |

How to invest in ESG funds: Step by step

Starting with ESG investment is fine. Many online broker and investment apps now include ESG screens and fund lists.

Here is a simple road map:

1. Open an investment account: first, select a mediation or platform, mortgage, loyalty, surprise or wealth-like app that provides ESG funds. See a section on the user-friendly ESG filter or “socially responsible investment.” You will enter personal information name, SSN, etc, and connect the bank account.

2. Determine your ESG criteria: Determine what matters to you. Do you want to focus on environmental issues such as low-carbon, clean energy, social problems such as sex diversity and work standards) or governance, for example, transparent management? Some funds also allow you to limit your from subjects such as climate, empowerment or social investments. For example, FTSE excludes social means of farmers tobacco, alcohol, weapons and fossil fuels. Write your priorities and minimize ESG rankings; many funds show a score or ranking.

3. Research ESG investments: Use your platform screens or third-party site to detect funds or shares that meet your criteria. ESG rankings, asset classes stock versus bond vs. mixed, filter by geography and fee. You can also ask a Robo commentary to handle it: Services such as improvement or Sustainfolio offer the ESG portfolio based on your risk level. If self-guided, you can read the fund’s summary: what they invest and how they show. Look at test herds and fees. If you are available, perform performance history short -term turns are normal.

4. Select and purchase: Once you have chosen a fund, you must keep a business. Go to “Buy/Business” in your broker app and enter the tick symbol, e.g. ESGV Vanguard ESG U.S. ETF or Nuveen ESG Large-Capt Nulg for ETF. Select an amount or number of shares and confirm. Your money will transfer and buy shares. Now you have invested! Monitor the effect and benefit of the fund over time, rebalancing as needed.

You can start small and variations. Consider dividing your money into some ESG funds, such as a wide U.S. fund and a pure energy fund. Many ESGs act like ETFs so that you can buy commission-free from large brokers. Before you buy, you can read the promotion or common questions about the fund a responsible fund will clearly outline the ESG strategy.

The best ESG Fund: Tips and Tools

When thousands of permanent funds are available, how do you choose the best ESG fund for yourself?

Here is the best procedure:

• Check the strategy and label: Means can notice yourself “ESG,” “Sustainable,” “Green” or “Effect”. Read how they use the criteria. For example, some “ESG” funds exclude only tobacco and firearms, while others are actively looking for renewable energy shares. Check what the fund excludes (fossil fuels, large pollutants, etc.) and what it contains. Agents that clearly reveal the screening criteria are usually more reliable.

• Use ESG rankings and research equipment: ESG score or rankings for platform funds and companies such as Morningstar and Sustainalytics. For example, the stability assessment of Morningstar (0–5 Globe) prices is investing, how the fund is a fund relative to peers. Many mediations let you filter after the ESG point. Yahoo Finance now shows the ESG point (out of 100) for public companies. Use these devices to cross the requirements for the funds. Do not rely completely on marketing: Data digging.

• Consider performance and fee: Sustainable wealth comes in taste, both active and passive. Inactive ETF -er (e.g., ESGG or Ishras DSI) tracks the ESG index and often has very low fees (some ~ 0.05–0.10% expenditure). The fees for active funds are high, but the market can be defeated if it is well controlled. Compare the results of the fund with a scale (e.g., S & P500 or MSCI ACWI). Remember that the previous results are not guaranteed but can show long-term record continuity.

• Look at ownership interests and diversification: Review the 10 best ownership interests in the fund. Are they regions (technology, health, energy, etc.) or tongues in an industry? Check if any companies collide with your values. For example, some pure-energy funds still keep electrical tools that burn natural gas. Also, make sure that the fund is not very small: Very small funds can have questions about liquidity or higher instability.

• Take care of greenwashing: This means that a fund claims to be beneficial for ESG but still invests in controversial areas. Read the financial or watchdog report on greenwashing (for example, some “sustainable” means were found to be large oil companies without revealing well). Stick to funds from eminent leaders known for ESG (Pawn, Fidelity, Blackrocks Ishares, Parnassus, Calvert, etc.).

• Use comparison and reviews: Read updated funds from reliable sources. For example, Nerdwallet and Kiplinger regularly top ESG ETFs and mutual funds. Compare some top options with the page. Morningstar and Yahoo User reviews can also highlight the professionals and resistance in each fund.

By combining these approaches, you can limit a list of “best ESG funds” for your needs. A balanced strategy is often the best: Choose a comprehensive ESG stock fund, a certain specific ESG fund and a theme-specific fund Clean Energy.

Top ESG funds and examples of trends

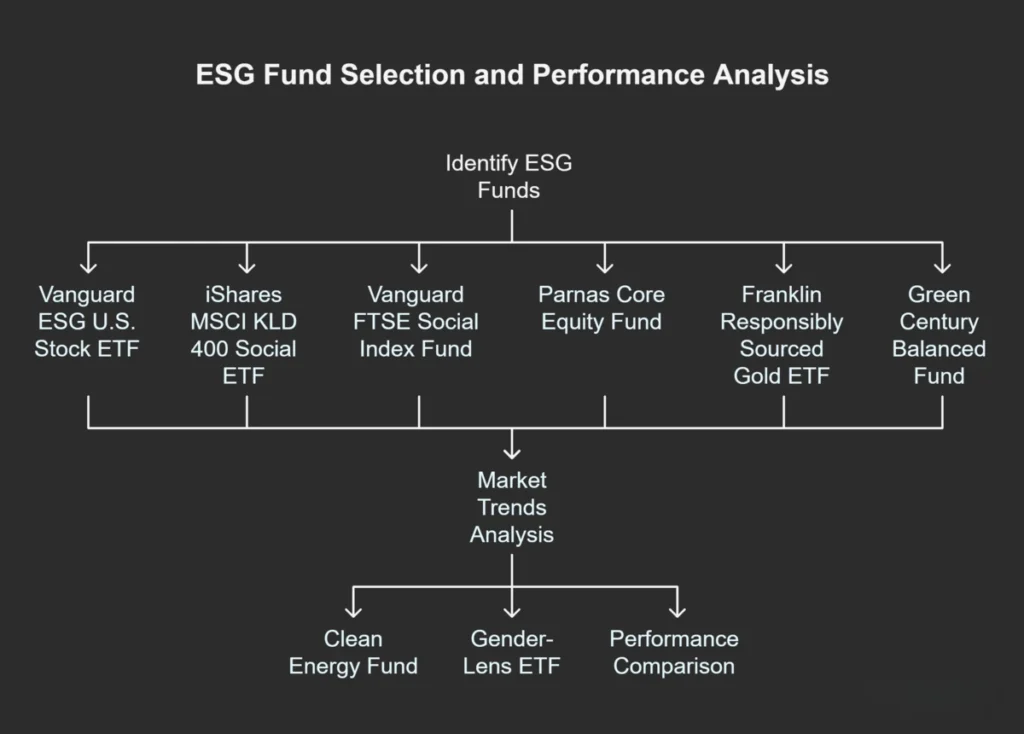

Here are some examples of well-known ESG funds (with reference 2024-25) that suggest what is there:

• Vanguard ESG U.S. Stock ETF (ESG) – a broad American stock ETF that excludes companies that fail ESG norms. It is popular for its Ultra-Loe fee (~ 0.09%). It provides the same exposure to large-cap as the S&P 500 but without oil, tobacco, etc.

• iShares MSCI KLD 400 Social ETF (DSI) – Spores 400 socially responsible U.S. companies (MSCI KLD 400 from Social Index). It is diverse in areas and excludes companies such as tobacco and firearms.

• Vanguard FTSE Social Index Fund (VFTAX) – a mutual fund except for tobacco, firearms, fossil fuels and alcohol. It is really the ESG version of the S&P 500, which permanent investors widely do.

• Parnas Core Equity Fund (PRBLX)- An actively managed large capital fund as screens for the environment and social results. It avoids companies with poor records (such as child labor) and is a long list of tracks dating to the 1970s.

• Franklin Responsibly Sourced Gold ETF (FGDL) – Franklin is responsible for an example of a niche ESG ETF that invests in gold from mines with social and environmental standards. In particular, FGDL ~ 40% YTD (April 2025) returned, showing that some “influence” properties could grow in this market.

• Green Century Balanced Fund (GCBLX)- This fund is 50% stock/50% bond and operated by an environmental non-profit. It only holds companies with strong ESG profiles, and there is no fee beyond investment.

It is also useful to see market trends. For example, the Clean Energy Fund and Gender-Lens ETF have recently seen an increase in interest. A chart or table can compare the performance of a top ESG fund against the S&P500 for more than 1-5 years (you can see if any ESG index matches or even defeats 2024 from the market). A proposed infographic: “ESG vs. Traditional Found Performance” or “2025 Top 5 ESG ETF,” exposes ticks as CHGX +65% or NULT (Nuveen) of x%, with the return.

Best Practices for Sustainable Fund Investors

• Stay informed: ESG is a rapidly developed area. Follow the iconic economic news, subscribe to ESG newsletters, or use the ESG screener website. Check updates on the rules (for example, SEC climate rules) that may affect the disclosures of the fund.

• Variation General: ESG investment still follows the core portfolio. Do not put ESG in just a small corner of bonds and non-ISG as needed for risk. Remember that a fund that is focused on the environment can be left in an energy room, while a management fund cannot invest in state-of-the-art technology.

• Regular reviews: Look at the portfolio for each fund again. Be careful if a fund leaves the word “ESG” in the name or manager’s strategy, be careful. Make sure it is still in line with your criteria. Use your broker app notice to monitor big news Asset Shifts or Regulatory Fines.

• Use community equipment: The app has ESG-centered platforms and analyzes in apps such as Fashion Flowers, Yahoo Finance or Morningstar. They can notify you of new means, cash flows or disputes. In addition, you can check if the pension or 401 (k) plans ESG funds offer alternatives – many are doing now.

The combination of these best practices will help you create a flexible ESG portfolio. And remember: Permanent investments are about long-term. Companies that manage ESG well can also withstand low regulatory bots and use consumer trends (for example, electric vehicles), which potentially lead to development over time.

Main takeaways and next step

Sustainable investment is not a passing mania – it has deep consumer and regulatory roots. For beginners or professionals equally, the approach is to assume ESG funds as part of a balanced portfolio: Do your homework, choose funds with strong ESG criteria and low fees and keep flexible as a development of markets.

To repeat:

• Define your goals: Are you most concerned with climate change? Corporate ethics? Determine your ESG focus.

• Use reliable data: Check Morningstar Rating or ESG point, compare the cost ratio and check the ownership interests.

• See for quality funds: Vanguard and iShares offer cheap, broader ESG funds; Active leaders such as Parnassus and Calvert provide concentrated expertise.

• Stay varied: Do not continue the last one-right miracles instead of a mixture of wider money with targeted money.

• Attach tools and visuals: Use screeners and even infographics (such as Flowchart or Comparison Table) to clarify options. In 2025, ESG is about coordinating portfolios with investment values and pursuing competing returns. With the right research and equipment, you can join millions of investors who have a positive impact through sustainable funds.

Conclusion: ESG Investment Future

ESG funds are more than just a trend – they represent a new financial philosophy. -When awareness increases, and the equipment becomes more accessible, ESG is no longer too morally operated; This is too financially intelligent.

From Emma’s first investment to institutional portfolio change, ESG Investing changes how we think about money.

Therefore, as we move on to a world where economic alternatives form the results of the real world, the question is, what kind of future will you make your money?