Imagine that you are a young entrepreneur in 2021, with more than $ 10,000 to $ 60,000 in Bitcoin, only regulatory whispering and marketing in the market to drop down between nervousness. Heart racing, you want to bet against the fall without selling ownership – valued by it instead of crushing it.

Today’s hyper-volatile Crypto Landscape Spo-Forward, where laws, Traders only do this through Crypto Futures trading. This powerful tool allows you to navigate the wild fluctuations of digital assets and make uncertainty an opportunity. In this broad guide, we will break down all the things you need to know, the latest 2025 data, and expert supported by insights.

What is Crypto Futures Trading?

Crypto Futures Trading is a derivative contract that allows you to agree to buy or sell Cryptocurrency at a fixed price on a future date.

In short, it’s not about owning real cryptos like Bitcoin or Ethereum, but there is speculation about their price movements. These contracts can be traditional (with a notice date) or always (running without end, using financing rates to combine prices with a spot market). This setup allows traders to benefit from positions, which means you can control large amounts with low capital – for example, 10x Gearing $ 1000 controls a crypto of $ 10,000 price.

Stems from the traditional economy, Crypto Futures exploded in popularity with platforms such as introducing him in 2019, and developed into a multi-trillion-dollar market by 2025. Long status in mechanics (rates on price increase) and short position (rates to reduce), held in cash or crypto. It is important to understand margin requirements: Original margin to keep it active to open a position, and maintenance margin, with liquidity risk if prices go against you.

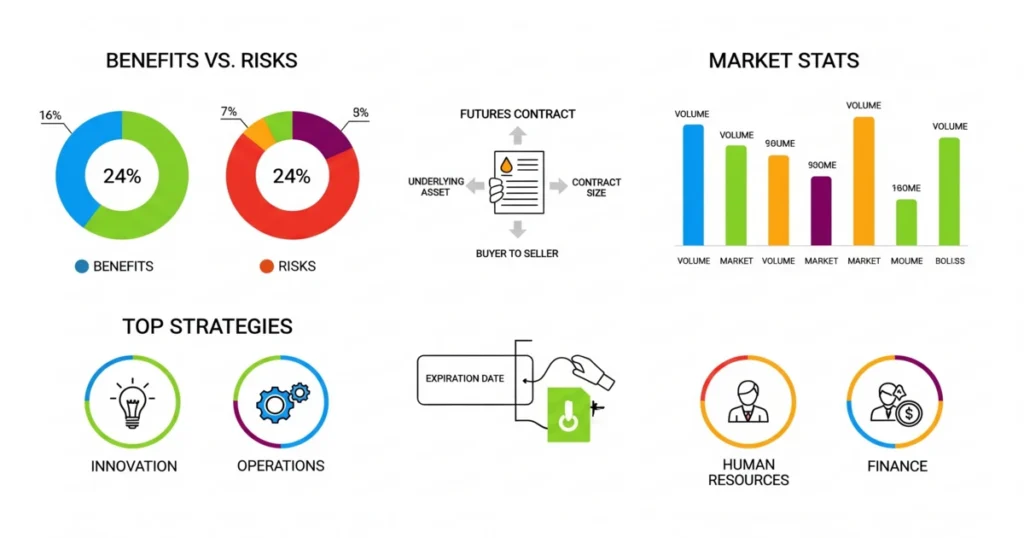

The Benefits of Crypto Futures Trading

Crypto Futures offers enthusiastic opportunities in a fast-moving market, appealing for both hedging and speculation.

A large profit is the gearing, which can increase the profits, and can meet the price of 5% in 50% profits with 10 times leverage. This is ideal for capital trade, so small accounts can participate in large features. Hedging is another advantage: If you catch Spot Crypto, futures can protect the price of your portfolio and preserve your portfolio’s value.

Liquidity is high, 24/7 spreads close to trade and larger stock exchanges, reducing grinding. Unlike spot trading, Futures enable a short seller without lending properties, open doors for profits in bear markets. Finally, regulated platforms provide openness and world search, and help stabilize the wide crypto ecosystem. In unstable times, these tools allow you the opportunity to diversify strategies beyond single purchases and holding.

The Risks Involved in Crypto Futures Trading

When they are rewarding, crypto-futures take significant risk due to the market that underlies unpredictable.

Volatility is the biggest danger: Crypto prices can fluctuate 10-20% daily, and utilize loss of loss 10% unfavourable step can delete your position with 10 times leverage. The liquidation occurs when your margin falls below the requirements and forces the potential total loss of automated closure and invested capital. Financing rates in always contracts can add costs when kept for a long time.

Regulatory uncertainty, with governments cracking down the derivatives in some areas, risks platform cuts or frozen means. Safety weaknesses, such as hack or exchange failure, persist despite improvement. Market manipulation, such as pump-and-dump plans, can distort prices. Finally, psychological risks such as coating or FOMO (fear of missing out) often lead to poor decisions. Always change with money you can lose and use risk management devices.

Key Statistics on Crypto Futures Trading

Crypto Futures Market has seen explosive growth, emphasizing its role in today’s digital economy.

In July, Derivative volume rose 53.7% to 2.2 trillion dollars, mostly since February, which was driven by the market’s rebellion. In that month, Binance alone dominated with $2.55 trillion in futures trading Volume market management. Daily crypto derivatives trading had an average of $ 24.6 billion increased of 16%, with an open interest in Bitcoin Futures.

Futures always constitute more than 70% volumes, which reflects the preference of traders for flexible, non-experienced contracts. Volatility matrix showed 30-day instability of bitcoin of about 50%, doubled as traditional shares, making futures a hot band for high-dung games. These figures highlight the maturity of the market, but also the sensitivity to global events such as regulatory changes.

How to Get Started with Crypto Futures Trading: Step-by-Step Guide

It is easy to join the crypto-futures, but preparations are required to avoid expensive errors.

Step 1: Learn yourself – start learning the basics through resources like Investopedia or exchanging training programs. Understand words such as leverage, margin, and long/short position.

Step 2: Select a platform – select reputable exchanges such as Binance or Kraken based on fees, utilization options, and safety.

Step 3: Sign up and verify an account, meet KYC (Know Your Customer) verification, and enable two-factor authentication for security.

Step 4: Fund your account – Deposit Fiat or Crypto e.g., BTC/USD perpetual) in the futures wallet; Start with a small amount like $ 100-500.

Step 5: Practice the demo – Use the Demo account for the platform to simulate trades without real money.

Step 6: Keep your first business choice a contract (e.g., BTC/USD always), always decide for long/short, set utilization (starts as 2-5x), and enter a stop-loss order.

Step 7: Monitor and adjust – Use tools such as track positions, diagrams, and indicators through the app, and end when the target is completed. Always go through the subsequent sessions with trades to improve.

Several exchanges lead the pack, offering robust tools for futures trading.

Here’s a comparison table of top platforms based on key features:

| Platform | Max Leverage | Supported Assets | Fees (Maker/Taker) | Key Feature | User Rating (2025) |

| Binance | 125x | 200+ (BTC, ETH, etc.) | 0.02%/0.04% | High liquidity, advanced charts | 4.8/5 |

| Bybit | 100x | 150+ | 0.01%/0.06% | No KYC for small trades, copy trading | 4.7/5 |

| Kraken | 50x | 100+ | 0.02%/0.05% | Strong regulation, fiat support | 4.6/5 |

| OKX | 100x | 300+ | 0.02%/0.05% | AI trading bots, high volume | 4.5/5 |

| MEXC | 200x | 250+ | 0.00%/0.02% | Zero maker fees, fast execution | 4.4/5 |

Effective Strategies for Profiting in Volatile Markets

Under Tadka conditions, smart strategies can cause instability in a partner.

- Scaling thrives in instability: Enter quickly trades to catch turns and small value exits.

Step 1: Use a 1-5 min diagram with indicators like RSI.

Step 2: Set a tight stop loss (1-2% risk).

Step 3: Dimensions for 5-10 trades per session, aimed at 0.5-1% profits for each.

- Hedging protects holdings: If you are the owner of BTC, short futures to offset spot loss.

Step 1: Calculate the size of the position by matching the ownership interests.

Step 2: Monitor the correlation.

Step 3: Close when the market is stable.

- Spread trade Exact price difference: Buy one contract and sell to another (e.g., BTC vs eth).

Step 1: Identify the corporate couple.

Step 2: Use a low length.

Step 3: Get out on convergence.

- Day trading takes the benefit of intraday features: Focus on news-driven instability.

Step 1: Analyze the daily chart.

Step 2: Use gearing.

Step 3: Close the session and complete all the posts. Always combine with risk management: diversification, use stop losses, and limit condition size to 1-2% capital.

FAQ

Q: Do I need to own crypto to trade futures?

A: No, futures let you speculate without holding the underlying asset.

Q: What’s the difference between perpetual and quarterly futures?

A: Perpetual have no expiry and use funding rates; quarterly settle on specific dates.

Q: Is crypto futures trading legal everywhere?

A: It varies by country; check local regulations, as some ban high-leverage trading.

Q: How much money do I need to start?

A: As little as $10-100 on some platforms, but start small to manage risks.

Q: Can I lose more than I invest?

A: Yes, with leverage, but many exchanges use isolated margins to cap losses.

Conclusion

Crypto Futures Trading stands as a two-edged sword in today’s unstable market for pilgrimage and exciting profit capacity through strategic acting that seeks respect for risks such as market fluctuations. With knowledge, by starting small on reliable platforms and using balanced strategies, you can navigate this site in an informative and effective way. As the market develops with strict rules and innovative units, the key is constant learning and disciplined execution. So, are you ready to change market volatility in your next big occasion?