Tattering on the border of the world’s economic system collapses, when Satoshi Nakamoto releases a mysterious figure, a white paper that will change the money landscape forever. Today, rewind to August 2025, and Bitcoin has evolved into a billion-dollar active class with a niche digital use. But what if you ever benefit from the wild value, swinging without the owner of a bitcoin?

BTC Futures enters Trading-A High-Day Game where loving traders change volatility in opportunities, hedging risk, or speculate in the future as modern. In this broad guide, we will demolish BTC -Futures, tie you with strategies to profit from today’s market, and all this is returned with the latest data, while maintaining a balanced, informative objective, which is still creative when it comes to highlighting the real-world applications.

What Are Bitcoin Futures?

Bitcoin futures are derived contracts that bind traders to buy or sell Bitcoins at a predetermined price on a specific future date.

These contracts allow you to speculate on the price movements of Bitcoin without owning real cryptocurrency, which presents the risk of instability through regulated exchanges. In essence, they are agreements based on the future value of Bitcoin, which acts on platforms such as CME groups or crypto-specific exchanges. Unlike spot trading, where you buy and own BTC immediately, you focus on the futures value.

This setup appeals equally to institutional investors and retailers, as it enables the benefits of positions for security or reinforced benefits against price drops. For example, if you estimate the growth of Bitcoin due to upcoming anchoring or ETF approval, a long future can multiply your profits. Historically, Bitcoin Futures were introduced at CME in 2017, which is a milestone in mainstream crypto. Today, the market share of Bitcoin $ 2 trillion in 2025 exceeds Futures, reflecting the growing interest in searching for volume of hedge funds and a diverse portfolio from everyday traders.

How Do Bitcoin Futures Work?

Bitcoin Futures work through standardized contracts, where traders agree on a price for BTC delivery at the end, but most are cash-settled without real Bitcoin stocks.

To break it step by step: First of all, choose a contract type – either the expiry dates or the traditional future that mimics prices without expiration. Second, decide on your position: long (bet on price increase) or card (bet on price decrease). For example, if BTC is at $ 60,000 and you buy a futures contract at the end of $ 62,000 in three months, you will benefit if BTC is more than the price of the settlement.

Third, use leverage, often up to 100 times on some platforms, which means that a small deposit (margin) controls a large position – but it increases both profits and losses. Fourth, you must always monitor the funding rate for contracts, where the long and short position pays each other to balance the market. Finally, close your position at the end to make a profit or cut a deficit. The mechanism allows traders to benefit from bull or bear markets, as seen in 2024 when BTC took a 20% dip, but still got sufficient returns in a small future. Understanding settlement cash vs. Physical distribution -important; Most BTC-Futures are cash-settled, which avoids the complications of crypto detention.

Benefits of Trading BTC Futures

Trade BTC -Futures provides opportunities for utilization, liquidity, and leverage that can increase diversification of portfolio and potential returns.

Utilization stands as a primary advantage so that traders can control large positions with minimum capital – for example, 5x Gearing means that 20% price moves can get 100% surplus on your margin. Liquidity is another advantage; Large exchanges such as CME offer deep order books, which also ensure quick execution during the unstable period. Hedging protects against side effects: miners or holders can reduce the future downturns by locking in excess between recessions.

In addition, the regulated environment reduces opposition risk compared to spot trade on irregular exchanges. In 2025, with institutional adoption, futures enable 24/7 trade, in accordance with the non-stop market for crypto. This access is a democratization of high finance so that retailers can participate in the strategies reserved for Wall Street. In addition, tax implications may be favorable to some courts, which treat the future as capital gains rather than normal income.

Risks Involved in BTC Futures Trading

When they reward, BTC Futures trading consists of significant risks including utilization-inspired losses, market volatility, and regulatory uncertainties.

High gear can delete your margin in a flash; 1% side effects of 100x utilization make your condition liquid. The inherent instability of Bitcoin has increased IT-5-10% daily turns being common, leading to rapid settlement. Financing degree fluctuations in always contracts can destroy the profits over time if the positions are held in the long term.

Systematic risk, such as Exchange Hack or Flash Crash, poses dangers to the state, where platforms stopped acting in the midst of extreme instability. Regulatory changes, such as potential CFTC, can affect liquidity or introduce new fees. Emotional disadvantages, such as overturning or losing positions, are often sufficiently damaged. In 2025, with an increase in the traditional markets for bitcoins, macroeconomic factors such as interest rates increase risk increase. Always use a stop-loss order and risk what you can lose.

Step-by-Step Guide to Getting Started with BTC Futures

To begin with, BTC Futures requires careful preparations, from choosing a platform to performing its first business.

Step 1: Education to the basics – read the resources from CME or Investopedia, which explains contract glasses as tick size and multiplier.

Step 2: Select an iconic platform; For American traders, include options such as Crypto Exchange, such as NinjaTrader or crypto.

Step 3: Open an account and provide funding for the identity, deposit Fiat or Crypto, and understand the margin requirements (usually 5-50%of the contract price).

Step 4: Analyze the market using technical indicators such as RSI or moving average, and basic news as basic news.

Step 5: Keep your business set. The contract, position (long/card), utilization, and set stop-loss/take-profit levels. Step 6: Monitor and manage tracing of real-time tracking, adjust as needed, and adjust close positions to ensure profit. Practice the first demo accounts to build trust without real capital at risk.

Profitable Strategies for BTC Futures Trading

Effective strategies include MIX analysis, risk management, and time to redeem Bitcoin movements.

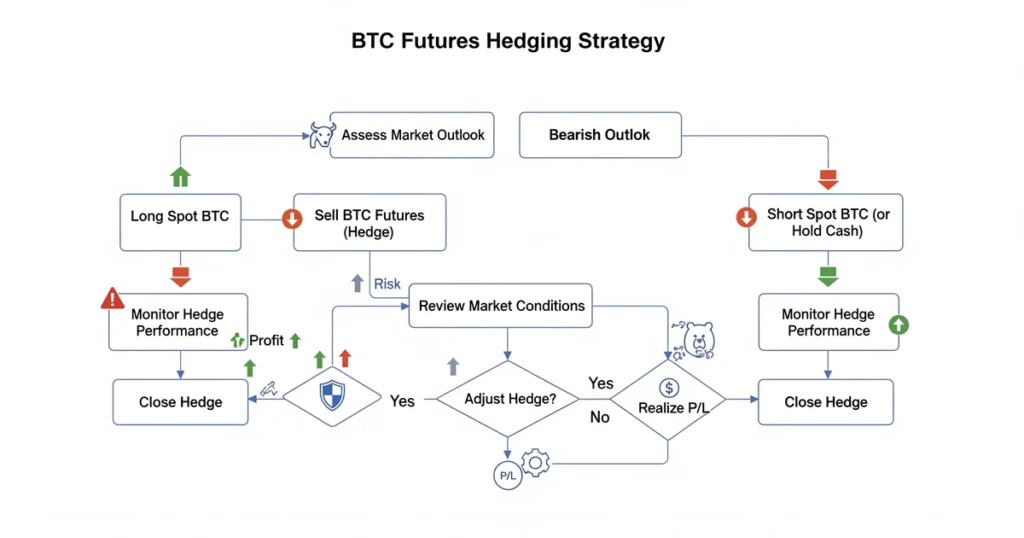

A balanced approach ensures: If you hold the place BTC, the short futures are to protect them from the recession while maintaining the opposite capacity. Scaling contains rapid trade in small value changes, penetrating/exit in minutes by using Ideal-5–10 X-Gearing for high transport contracts. The benefits of day trafficking Volatility: Buy low in fall, sell high on rallies, directed by candlestick patterns. Swing keeps the position for days/week, games on trends as an increase after ETF approval.

Arbitrage utilizes the price difference between the places and the futures markets for low-risk benefits. Momentum Trading rides strong trends, entering the lengths during the opening, improved by news. Always include stop-loss, include a variety and backtest strategies. In 2025, AI equipment can adapt them to better results.

Key Market Statistics for 2025

The BTC Futures market shows strong growth in 2025, with the open interests collected between institutional clients higher.

In mid-2025 dollars, open interest in total BTC -Futures exceeded $ 120 billion, which reflected increased speculation in 2024, over $ 50 billion. The daily trade volume rose to around $ 316 billion, powered by platforms such as Benance and CME. CME Bitcoin Futures alone saw an average daily volume of more than 17,000 contracts, equal to billions of dollars. Open interest in Deribit and other derivative platforms indicates a price for December 2025 contracts, which is about 2.86%, indicating quick emotions. This data outlines Bitcoin’s maturity, including futures, which is 40% of the total cryptocurrency derivative volume, according a Coinmarketcap data. Volatility remains high, with the levels contained around 60%, which provides profit opportunities, but requires caution.

This table compares top platforms based on 2025 data, emphasizing factors like leverage and regulation for informed choices.

| Platform | Leverage Offered | Fees (Maker/Taker) | Key Features | Regulation | Best For |

| CME Group | Up to 5x | 0.02%/0.04% | Regulated cash-settled contracts, high liquidity | CFTC (US) | Institutional traders |

| Binance | Up to 125x | 0.02%/0.04% | Perpetual futures, wide pairs | Varies by region | High-leverage seekers |

| Kraken | Up to 50x | 0.01%/0.02% | Advanced charting, margin trading | FinCEN (US) | Beginners with security focus |

| Bybit | Up to 100x | 0.01%/0.06% | No KYC for small trades, fast execution | Seychelles | Day traders |

| Deribit | Up to 100x | 0.02%/0.05% | Options alongside futures, high open interest | Panama | Advanced derivatives users |

FAQ

Q: What is the minimum capital needed for BTC futures?

A: It varies by platform; CME requires around $5,000 margin per contract, while crypto exchanges start at $100 with leverage.

Q: Are BTC futures taxed differently?

A: In the US, they’re treated as Section 1256 contracts with 60/40 tax splits—consult a tax advisor for your jurisdiction.

Q: Can I trade BTC futures 24/7?

A: Yes, on most crypto platforms; traditional exchanges like CME follow market hours.

Q: What’s the difference between futures and options?

A: Futures obligate action at expiration; options give the right but not the obligation.

Q: How do I avoid liquidation?

A: Use conservative leverage, set stop-losses, and monitor margin levels closely.

Conclusion

When wrapping this exploration of BTC Futures trade, we have seen how these devices convert Bitcoin volatility to a playground for speculation, security, and gains, increasing nowadays figures such as $ 120 billion in open interest rates and innovative strategies, which balance the risk with the price. Due to the market in the market, squeezing education and disciplined approaches.