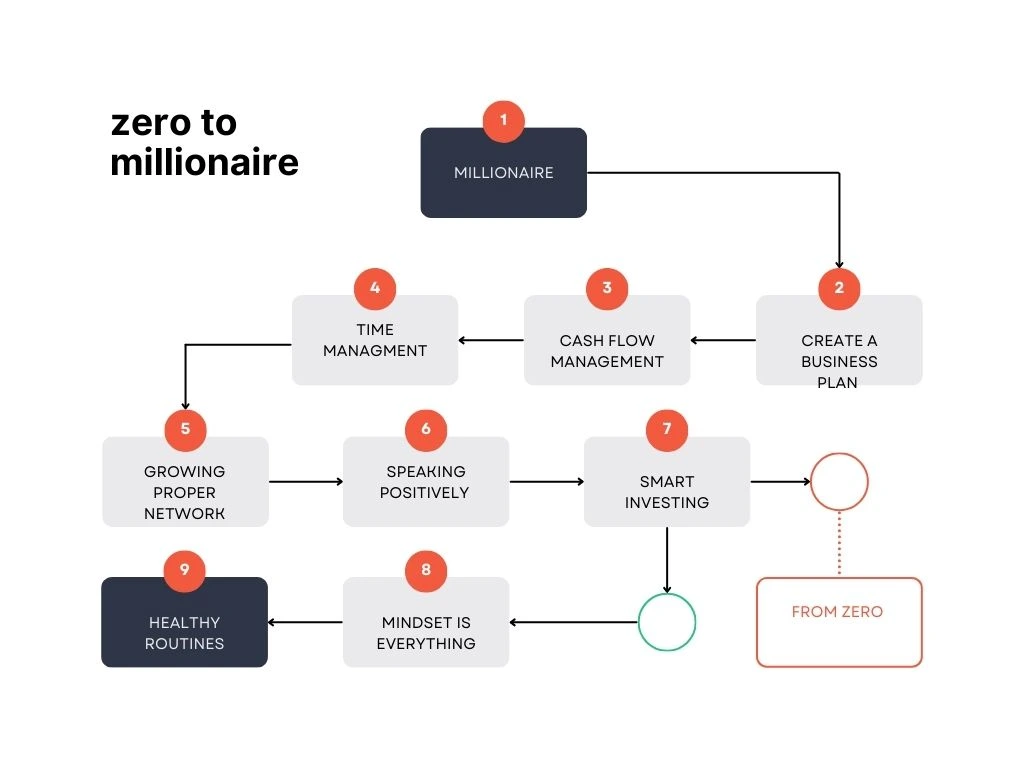

Becoming a millionaire is an attainable goal for many, but the journey from zero to financial success it requires discipline, strategic planning, and a commitment to financial education. In this article, we will explore essential strategies and insights on managing money like a millionaire, investing wisely, and transforming your daily routines to achieve financial success.

How to start zero to millionaire?

Become a millionaire with good financial management, wise investment and thinking of money as millionaires do. Roughly 21 million people, or about 8% of the population are classified as millionaires in the U.S., based on recent data It can seem as though money is unattainable but there are very clear actions that the prosperous often realize.

Start by prioritizing savings. While most financial gurus say save 20% or more of what you make, saving ANY constant amount will build wealth over time. Put some of your savings in investments like stocks, index funds or real estate – these have better returns than a regular saving account. The stock market, for example, has seen average annual returns of 7-10%.

Debt management is crucial. Working to pay down high-interest debts (credit card debt) combined with low-cost loans should be used for investments in income-generating assets. And a decent credit score should even allow you to enjoy better interest rates when borrowing.

Multiple income streams like side hustles can help you bring in money faster, helping on your path to wealth. Hundreds of thousands, if not millions, have passive income businesses involving investments in land or rental properties. Investing at an early stage is all good, however, continuous Education on personal finance, market trends and investment strategies are required which would actually make your decision sharper. This is not something that you can achieve in 1 year or 2 years, but by following these steps and remaining faithful to yourself with time it’s possible.

| Financial Metric | Current Data (USA) | Percentage/Ratio |

|---|---|---|

| –Savings Rate: | -7.6% (as of 2024) | -National average |

| –Emergency Fund Savings Goal: | -3-6 months of living expenses | – |

| –Debt-to-Income Ratio: | -36% (recommended maximum) | -36% (Average DTI) |

| –Average Credit Card APR: | -19.6% (as of Q1 2024) | – |

| –Retirement Contributions: | -15% (recommended minimum) | -For long-term growth |

| –Homeownership Rate: | -65.6% (as of 2024) | – |

| –Median Household Income: | -$70,784 (2023 data) | – |

| –Percentage of Millionaires: | -8.8% of U.S. households (2023) | – |

| –Net Worth of Average American: | -$121,700 (2023 data) | – |

| –Investment in Stocks: | -55% of American households | – |

Everyone is a millionaire, how?

While becoming a millionaire may seem like an unattainable dream, with the proper mindset and habits it is possible.

- Mindset is everything; if you think money and success are for other people but not for you, unfortunately that’s what your experience will continue to be.

- Many of the self-made millionaires in recent studies have positive attitudes, concentrate on solutions and not problems. They work hard, many times getting up before the sun comes out to start their days in order squeeze every minute of it.

- Key to millionaire success is smart investing. By 2023, there were 22 million millionaire households in the U.S., who typically say that diversified investment is key to their financial development.

- Regularly setting aside a bit of money for investments like stocks, real estate and retirement funds can result in massive wealth accumulation as the earnings on those savings compounds over several decades.

- Healthy Routines—otherwise known as Habits, are another parallel. People who are highly successful also find exercise, meditation or yoga important because they help clear up the mind and body to work in peak form.

- Speaking positively reading continuously broadens the mind and increases communication channels leading to beneficial relationships.

- Such AS: Dressing like Living in The Professional Manner and Building Coop with Confidence AND Growing Proper Network.

Just these simple yet powerful habits are enough for anyone to become a millionaire, teaching us that goal of financial success is always within your reach as long as you follow the right track.

What is the secret of millionaire?

The Secret of a millionaire is not only earning high income but also Money Management. 88% of millionaires are self-made, over half became a millionaire by being consistent in their investments and smart about saving money (Fidelity). Disciplined spending as the foundation of your financial plan, millionaires deploy budgeting savings and investment as their pillars.

According to the 2023 Knight Frank Wealth Report, even amongst high-net-worth individuals (HNWIs), with around three-quarters still ensuring a diversified portfolio that might include stocks and bonds as well as real estate which is used for managing risk exposure affecting wealth generating or preservation potential within volatile markets.

Warren Buffet is probably the most universal for its value-investment in addition to his frugal lifestyle. At his level of wealth global wealth, Buffett famously lives modestly in the same house he bought in Omaha for $31,500 back 1958. The millionaire mind set is very similar to his long-term investment mentality, paycheck reinvestment and resisting the urge on impulse buys.

Many millionaires adhere to the principle of paying yourself first, by saving a standard percentage of income before making room for expenses. This proactive financial mentality supplemented by diversified investments and sound financial education which I will reveal in a bit, is one of the fundamental secrets to creating and maintaining millionaire wealth under any economy.

Get start Your Own Business

Owning your own dirt road (i.e. running a lifestyle business) is 100% better than being on the highway to riches so roll our sleeves up and get started. Getting an enterprise off the ground starts with some necessary planning, which can cost a bit, but it will pay dividends over time. According to recent figures, financially healthy companies can achieve 60% in growth compared with their less managed rivals and nearly one-fifth more profitable.

If business owners are struggling, they must be ruthless in watching cash flow, reducing costs wherever possible and investing into areas with a strong ROI.

So those are the Key Takeaways from Financial Management Property Admin Business.

- Create a Business Plan (including projections on revenue, cost to start-up and breakeven).

- Cash Flow Management: Keep a close eye on your inflow and outflow that is otherwise said to help in Generating Positive Cash Flows.

- Get Tax & Cash Flow Efficiency Create different accounts, separate bank account for personal and business. Track cash clearly so no trouble at tax season.

- Invest and Scale: Reinvest in your business, you need to scale the right way

- Build a Buffer (Operational Runway) · Regular reserve money for unforeseen expenses.

- Budgeting: controls costs (to place spending for some reasons)

- Enables Cash Flow Monitoring — Prevents shortfalls to keep the business running.

Invest: Emergency funds for small businesses to support health economic growth. Consolidation deals are very beneficial for dealing with more expensive DCLOS. Personal and professional accounts will not only be beneficial from a timekeeping perspective but also for tax purposes.

And money is very much needed to have some chances of the company that we are going to prosper, how much can you make in each period!

Frequently Asked Questions (FAQs)

How much money do you need to be considered a multi millionaire?

Dated ways of describing someone worth n millions are “n-fold millionaire” and “millionaire n times over”. Still commonly used is multimillionaire, which refers to individuals with net assets of 2 million or more of a currency.

How are millionaires calculated?

A millionaire is somebody with a net worth of at least $1 million. It’s a simple math formula based on your net worth. When what you own (your assets) minus what you owe (your liabilities) equals more than a million dollars, you’re a millionaire. That’s it!

What is the secret to becoming a millionaire?

To become a millionaire, start saving early and invest your money to take advantage of the power of compounding interest. Savvy savers limit their spending so that they can put more money to work for them. Maximize your retirement contributions every year to earn tax-deferred or tax-free growth.

How much money needed to be a millionaire?

When we say “Millionaire”, it means someone who has a total net worth of around $1 million, or Rs 8 crore in Indian currency apart from the house they live in!

Conclusion

It is possible for anyone that follows smart financial habits, invest in the right spaces and maintain focus. Just adhere to these principles and you can turn your ambitions into actuality. Applied consistently, these are the strategies that can set you on a path to millionaire; Keep in mind that money and freedom work at the level of dollars, every next step is important on what will then be your retrospective journey to financial independence.