Entering the age 30 is a big deal for everyone who is turning thirty. At this point in their lives, most individuals have already gone through education, started working, as well as began contemplating how they should spend the rest of their lives if for instance they want to own a house, have a family, or be prepared for old age. But then again, is there a certain amount of money that you should aim to save by 30? This is a question that many seems to pose but is not answered due to such factors as lifestyle, income and so forth.

How Much Money Should You Have Saved by Age 30? Are You on Track? This article sets out some general targets, aspects you need to take into account, and methods for evaluation of how close you are to your aim of achieving your financial targets by the age of thirty.

How Much Money Should You Have Saved Up When You’re Touching 30?

Target equity at age 30 according to most finance professionals, is equal to scope to an individual’s annual salary. If for instance, you make $60,000 in a year, then $60,000 is your target figure since you should have set aside that amount towards achieving that particular income. This is savings including cash, retirement savings accounts and any other investments.

This goal is based on the rule that you should save a year’s salary by the age of 30, double that by the age of 40 and keep on saving even as age creeps up on you. There is some level of standardization of achievement that depends on educational expenses, employability, and expenditure patterns for individuals.

Financial Goals To Achieve By Age 30?

Reaching the age of 30 implies the need to achieve certain major financial objectives in the USA to be financially secure in years to come. To begin with, it is usually advisable to make sure that an individual has in place an emergency fund of 3- or 6-months’ worth of living expenses so as to ensure that that person meets his or her basic financial needs.

Secondly, whether it followed by social security or not, they must begin by attempting to save retirement funds within the range of no less than 15% of their salary whether through 401 (k) plans or IRAs in order to take advantage of compounding benefits. On top of that, it is also worth noting that budgeting should also include repayment of current obligations and making a conscious effort to reduce the amount of debt especially revolving debt such as credit card debt. Lastly, there are a good number of people who try to buy a house by first saving and at least making a 20% down payment which serves to improve investment returns.

Read More: https://trekandtrade.com/financial-freedom-how-to-save-strategically/

Debt and Student Loans: Taking Care of Debt for Financial Independence

Debt is one of the most important reasons why many people don’t save money, especially young people. It can be very difficult to save money if you have a considerable amount of college loan debt, a big mortgage, or high credit card debt. But savings and debt payment should be viewed as equally important. There must be a balance between spending on savings and paying down the debts, and this balance must be found.

Income and Salary Growth: Strategies for Featuring Income Growth Throughout One’s Career

Everyone’s career growth is different from the other person either it is up or down. Some individuals may well be straight out of college themselves pressed into positions with bountiful incomes, while t others struggle for several years before s stable earning income. How fast, or slow, one’s salary grows is essential saving potential. In one’s twenties, if a low wage has been earned, it would take more time to save a years’ worth of salary. For other individuals that commence on a higher salary, it would be possible to save a much larger amount at a lower time.

Lifestyle and Expenses: Smart Spending Habits for Long-Term Savings

Your saving potential is directly proportionate to your spending. Most of them are likely to encounter a lifestyle which includes significant expenses, such as constant jetting out on holiday, eating out a lot, or buying expensive gadgets and clothes, which will prevent great savings. Yet on the other hand, spending modestly and saving more ensures more opportunities come future. The most important thing is to find the point when you still enjoy your beginnings of adulthood and having fun while you are also ready to think about your future and achieving success by the time you are 30 years old.

Retirement Accounts and Investments: Growing your Wealth for the Future

| Debt Type | Total Debt | Interest Rate | Minimum Payment | Years to Pay Off |

|---|---|---|---|---|

| Credit Card | $5,000 | 18% | $150 | 3 years |

| Student Loan | $20,000 | 6% | $250 | 10 years |

| Car Loan | $10,000 | 5% | $200 | 5 years |

Each of these plans has its balance of risk and return accompanied by retirement savings. Considering retirement accounts if one has an employer-sponsored 401(k) account with matching contributions or individual retirement accounts puts one way ahead in investing. Time value of investing makes a lot of sense when it comes to trying to figure out how to go about the whole retirement saving cycle. Saving small amounts at a very young age allows one to take advantage of compounding, paving the way for larger amounts at retirement.

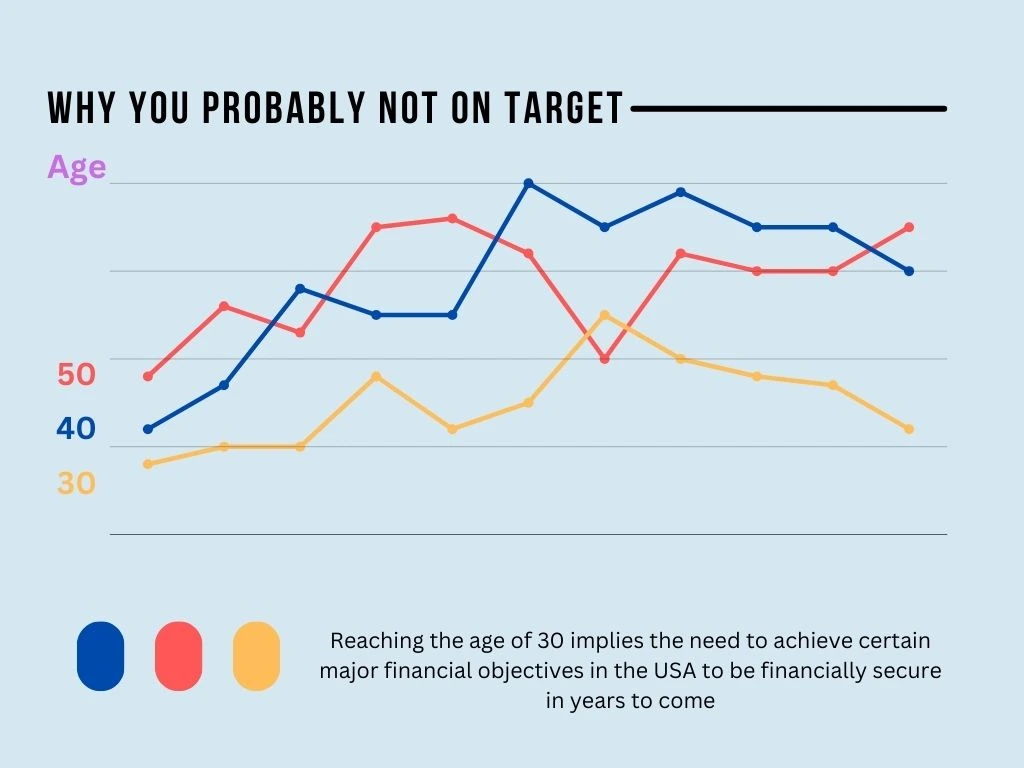

Why You Probably Not on Target

One observation is that many individuals cross the age of 30 years with minimal savings than anticipated. There are many good explanations for this, and it is good for the reader to realize that such indicators should never be mistaken for goals. Some common factors that may contribute include:

Loan repayment: Most individuals incur huge amounts of loans in particular to fund their college education and end up spending their twenties trying to pay off such loans rather than saving up.

High-cost areas: Residents living in cities for example New York and San Francisco where the cost of living is particularly high are likely to spend more on rent, food, transport, other utilities and commuting to work than their counterparts in lower cost living economies.

Unstable employment: The primary high demand and opportunities laden stage of career entail job quitting daytime activity or frequency of jobs or underemployment which most likely does have positive savings that can be made.

Medical emergencies: There are emergencies that come up that can use all the savings one has directly or indirectly such as medical emergency or other emergencies.

Strategies to Get Back on Track

If you’re behind on savings do not break a sweat. There is more than enough leeway to get out of the rough and restore your financial goals back again.

How to increase Savings?

In as much as you might feel that you are hopelessly behind, it is possible to play catch-up by saving a greater proportion of your income in savings. Certain guidelines recommend a monthly percentage of between 15-20% towards saving, but if you are catching up, save more. Some of the most efficient ways of saving for the individual is automating their monthly salary where a percentage is deducted towards a recognized bank that allows savings.

How to Budget and Expense Tracking?

First off, make a draft of an estimated budget for your earnings and expenses. Pinpoint things that can be reduced such as fast food, movie nights, and magazine and TV subscriptions. Use that extra money on savings. Applications like Mint, YNAB (You Need a Budget) and Pocket Guard will assist in controlling your expenditure.

How to Side Hustles and Additional Income?

If you want, you can also try having a side job which can earn you some more money. Working from home for companies like Upwork or selling on Etsy or driving for Uber can make for additional income which can make you reach your savings goal.

How to Pay Down High-Interest Debt?

High-interest debt such as credit cards can become a major hindrance in the building of savings anywhere. What needs to be done is put emphasis on eliminating this debt while conserving what can be put aside for later. After paying off this type of debt, resources can be set aside for savings.

How to Maximize Retirement Contributions?

If your place of work has a retirement match, go ahead and make enough contributions to take advantage. Alternatively, both a Roth IRA and a 401(k) are options worth considering. At this point, it can be said that retirement accounts are a great way to save money because they have tax benefits and the potential for compounding.

Read More: https://trekandtrade.com/emergency-fund-why-is-it-important/

| Age | Savings Goal (Multiple of Annual Salary) | Explanation |

|---|---|---|

| 25 | 0.5x Annual Salary | By age 25, aim to have half of your annual salary saved. This includes emergency funds, retirement savings, or other long-term goals. |

| 30 | 1x Annual Salary | By age 30, a common goal is to have saved at least your full annual salary. This should cover emergency savings, retirement plans like 401(k) or IRA, and other investments. |

| 35 | 2x Annual Salary | By age 35, financial experts recommend having twice your annual salary saved to stay on track for long-term financial stability. |

| 40 | 3x Annual Salary | By age 40, having three times your salary saved prepares you for both retirement and other major life events (e.g., home ownership, children’s education). |

Conclusion

It is regarded as normal for someone below the age of 30 to have saved the ladder or the equivalent of their yearly income. But there are some variables that can hinder reaching this milestone. High student debt, costs of living, or not getting stable employment are the most common reasons. Thought, loss of control can be gained by implementing a budget, clipping down essential expenses, boosting the savings rate, as well as debt. Those are directions only, no two journeys towards financial security are the same.

Frequently Asked Questions (FAQs)

How much should a 30-year-old be saving?

Here’s how much cash they say you should have stashed away at every age: Savings by age 30: the equivalent of your annual salary saved; if you earn $55,000 per year, by your 30th birthday you should have $55,000 saved. Savings by age 40: three times your income. Savings by age 50: six times your income.

How much money should I have in my 401k by 30?

By age 30, Fidelity recommends having the equivalent of one year’s salary stashed in your workplace retirement plan. So, if you make $50,000, your 401(k) balance should be $50,000 by the time you hit 30.

Where should I be financially at 30?

By 30, you should have a decent chunk of change saved for your future self, experts say in fact, ideally your account would look like a year’s worth of salary, according to Boston-based investment firm Fidelity Investments, so if you make $50,000 a year, you’d have $50,000 saved already.

Is saving $1000 a month good?

Saving $1,000 per month can be a good sign, as it means you’re setting aside money for emergencies and long-term goals. However, if you’re ignoring high-interest debt to meet your savings goals, you might want to switch gears and focus on paying off debt first.